🎣 Spot Rates Spike

Plus: holiday trucking shutdowns, a broker liability bill facing pushback, DOT threatening funding over failed CDL audits, and more in today’s newsletter.

Explore ISO's transformative approach to freight data: bridging gaps, unifying metrics, and steering the logistics industry towards a standardized future.

The freight industry has gone through some major pivots throughout the decades. With the rise of data-driven solutions entering an increasingly fragmented market, we’re overdue for a conversation about data standardization. Imagine a logistics landscape where a single source of truth guides brokers, carriers, and shippers alike, bridging gaps, unifying metrics, and eliminating the chaos of countless conflicting data points that fuel our understanding of what really happened with any given shipment.

ISO is focused on just that, forging a future where transparency, efficiency, and consistency reign supreme.

Deregulation and its Impacts (1980): In 1980, the freight industry underwent a seismic shift with deregulation, paving the way for a surge of new entrants. This era marked a period of intensified competition and the necessity for innovation to sustain and grow in the market. Shippers came to expect a higher level of service quality during this time.

Transition to Technology (2000s): The new millennium brought technology into the fold, with limitations. Though a leap forward, early Transport Management Systems (TMS) were hindered by bulky and inflexible infrastructures, sowing inconsistency in freight data.

Tracking Data and Enhanced Visibility (2010s)

In the 2010s, a surge in tracking and enhanced visibility began to reshape logistics. The advancement of integrated TMS and Internet of Things (IoT) technologies, like RFID, bolstered supply chain transparency and operational efficiency. Despite leaps in technology and analytics, hurdles like incomplete visibility continue to impact the cohesive logistics strategy and global supply chain collaboration.

Consumer demands, fueled by Amazon Prime

The late 2010s saw consumer expectations skyrocket, driven by Amazon Prime's influence. The mounting demand for real-time tracking (90% of consumers want to track their delivery orders) and expedited delivery heightens the need for comprehensive, effective tracking and a deep understanding of service failures across networks.

The Challenge of Standardization: With multiple technologies and processes at play, the absence of standardized performance metrics and KPIs made data incorporation challenging, leading to tangible operational setbacks.

Today's hyper-connected world and the demands of shippers amplify the necessity of streamlined data in the decision-making processes in freight brokering. E-commerce growth intensifies the demand for precise, timely shipments, yet data inconsistencies pose challenges.

These issues have highlighted the need for integrated systems. Companies like Echo Global Logistics, Convoy, J.B. Hunt, and Uber Freight have recognized this, leading to the formation of the Scheduling Standards Consortium (SSC). This consortium aims to:

Advocate Industry-wide: The SSC isn't just for the founding members. As the initiative progresses, more players, including brokers, TMS vendors, and more, are expected to join in, shaping the future of supply chain efficiency.

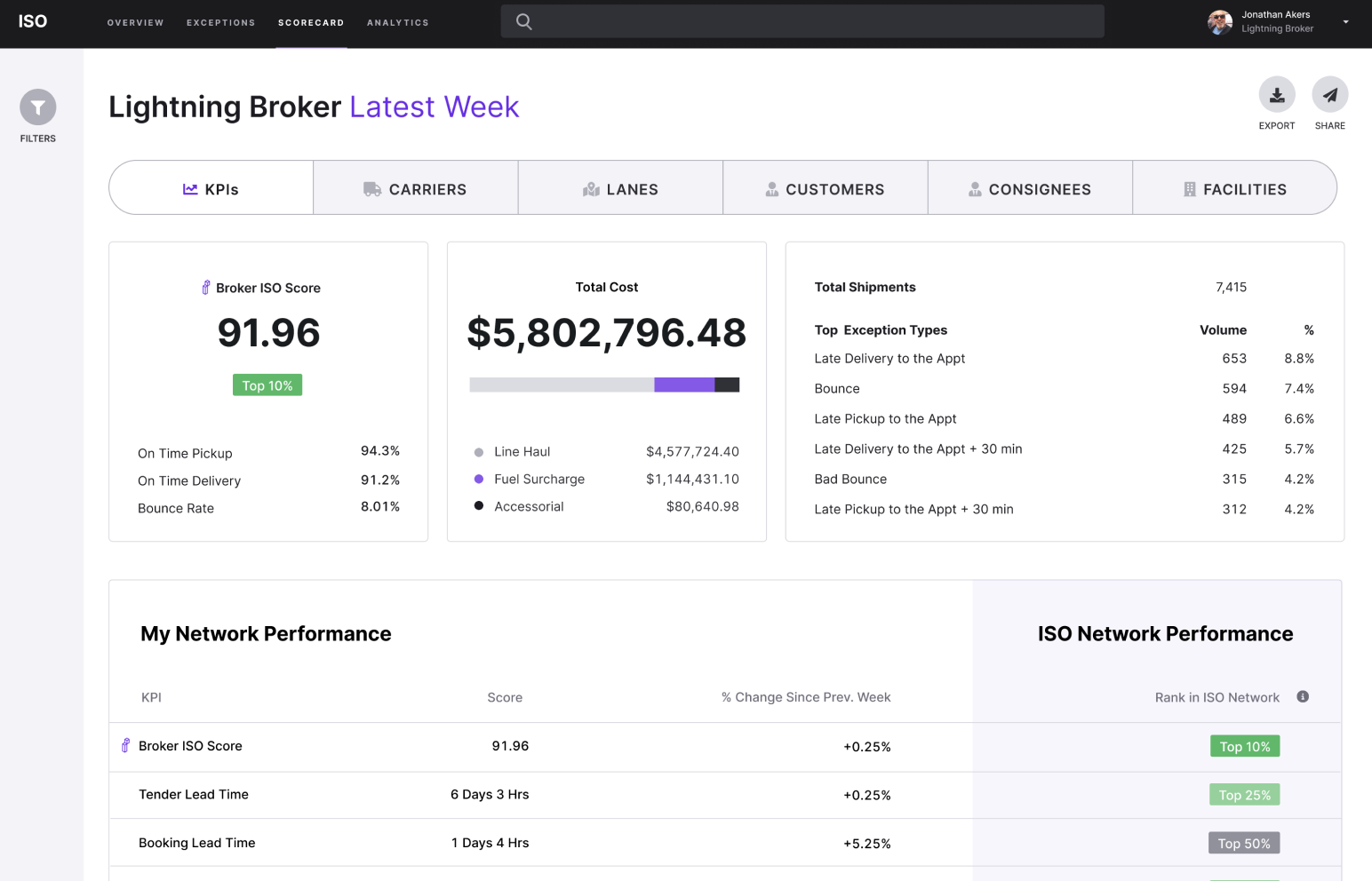

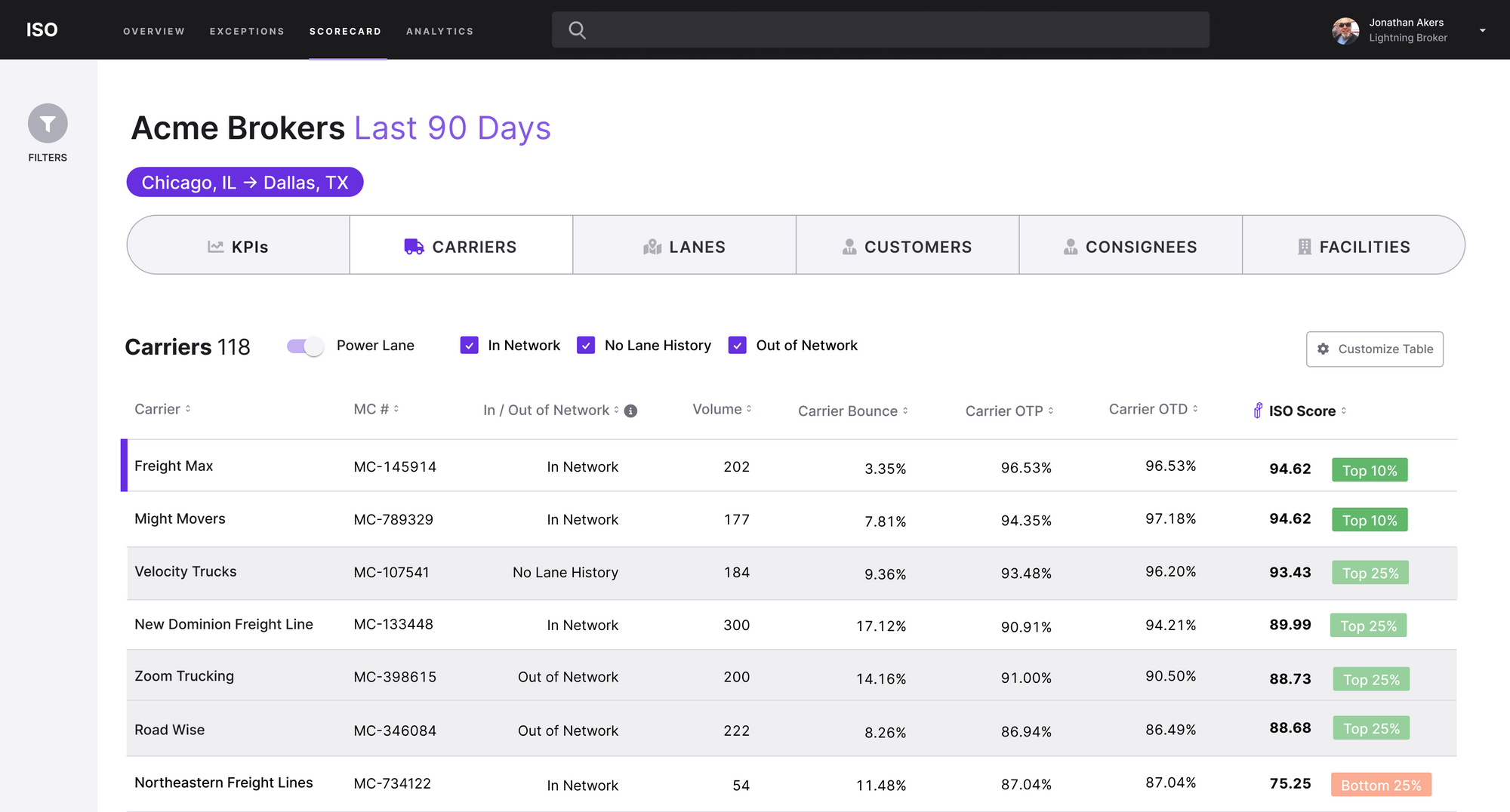

In a fragmented industry clamoring for unification, the advent of ISO signals a transformative shift towards standardization, particularly in service-level performance measurement. Echoing impactful initiatives like the SSC, ISO is pioneering a parallel movement, focusing on streamlining performance measurement standards within the freight domain.

ISO's approach is a comprehensive response to the industry’s outcry for consistency and transparency. As the industry navigates through diverse definitions and metrics, ISO emerges as a unifying force, standardizing crucial transportation KPIs such as on-time to appointment, tender acceptance, and tracking compliance. This standardization is not just a theoretical framework; it’s a practical toolset designed for immediate application and tangible improvement.

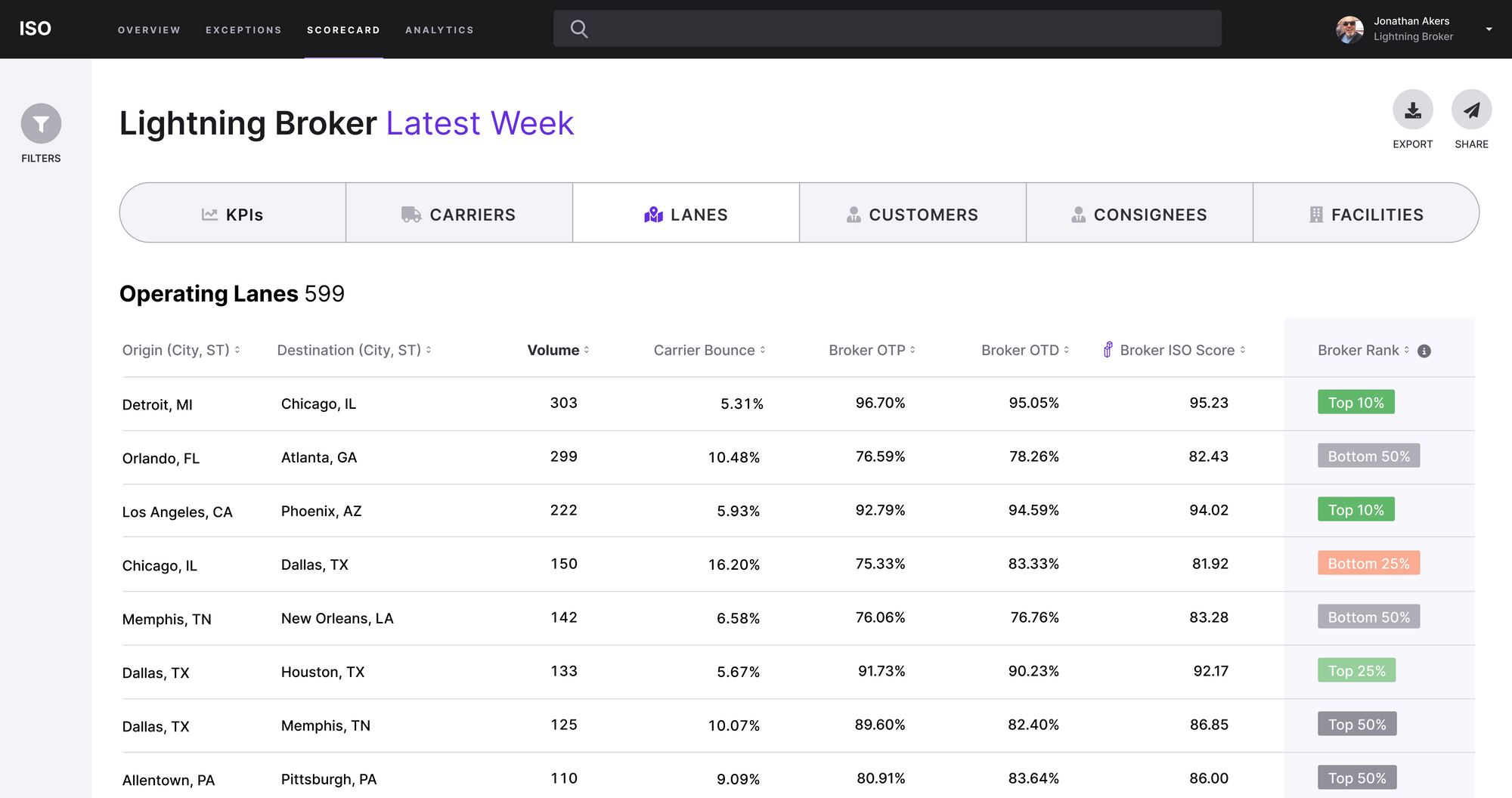

ISO Lane Benchmarking & ISO Power Lane

And this is just the beginning. A slew of features awaits later this year:

The freight industry's journey, marred by data inconsistencies, now heads towards an era of standardized, accessible, and dependable performance data, holding the promise of streamlined operations and enhanced customer satisfaction. ISO is leading the charge. Find out more by visiting iso.io.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).