🎣 The Perfect Stolen Load

Plus: backlash over carrier safety rankings, the Port of LA’s push toward 10M TEUs, states expanding ICE enforcement, and more in today’s newsletter.

Despite earlier concerns, U.S. container imports are on the rise, surpassing pre-COVID figures.

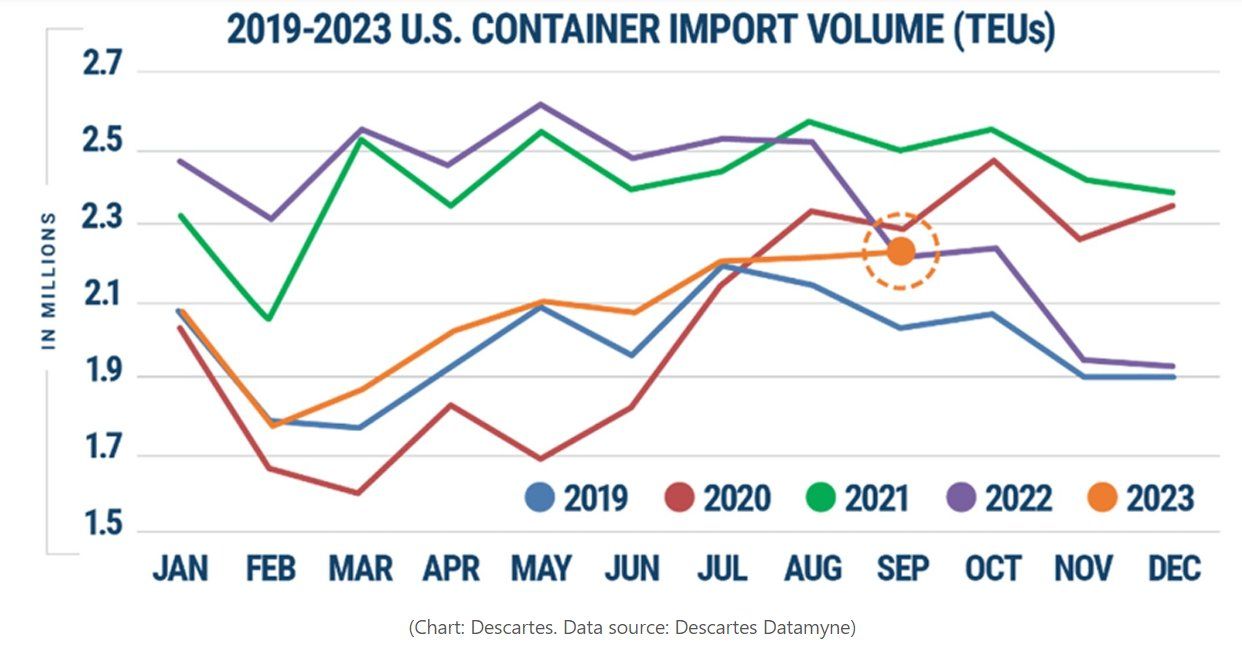

There has been a lot of doom and gloom about the state of U.S. imports, but here's a refreshing twist: the numbers are anything but. U.S. imports have been steadily climbing since February, and September's data from Descartes Systems Group proves just that.

September's Surge: U.S. imports hit 2.2 million TEUs in September—an impressive 27% leap from February's Chinese New Year low. This month's figures crushed typical September expectations, showing an 8% growth from 2019 and a hefty 15.5% rise over 2017.

Initially, it may appear that import numbers are bad if you're comparing them to the inflated levels seen during the COVID-era shipping boom from 2021-2022. That is just a case of recency bias, where we tend to overemphasize recent events when predicting the future.

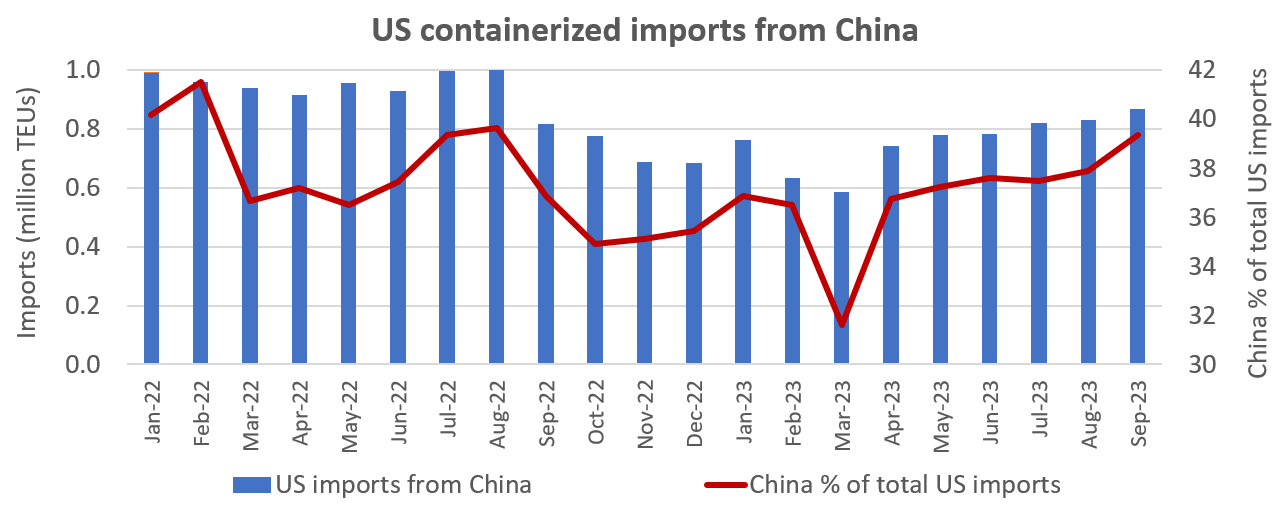

China's Grip: China solidified its status as a chief U.S. import driver in September. Imports rose by 4.2%, making up a massive 39.3% of the total—the highest since August 2022.

Retailer Insight: The National Retail Federation (NRF) predicts healthy cargo volumes for 2023's tail end. Retailers played it smart, stocking up early to sidestep supply chain hiccups. Although NRF dialed down its yearly forecast from 22.3 million TEUs to 22.1 million, it's still a commendable rise over the pre-COVID years.

Rate Reality: Trans-Pacific spot rates hint at a Q4 cool-down. The FBX reports China-East Coast spot rates have dipped 24% since August 17, but let's not forget they're still 26% higher than June 30.

In essence, while U.S. container imports might not match the pandemic frenzy, they're undeniably thriving.

Source: FreightWaves

China's total goods imports and exports continued to improve in September, with the trade volume reaching a new monthly high of this year, official data showed Friday.

— Hi,GBA (@thisisGBA) October 13, 2023

The foreign trade volume reached 3.74 trillion yuan (about 521 billion U.S. dollars) last month, registering… pic.twitter.com/Qf17L8KSXB

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).