Why Now Is the Best Time to Be an Independent Freight Agent

The market’s brutal, sure, but for freight agents with the right tools, it’s prime hunting season. Here’s how they’re making it work.

The market’s brutal, sure, but for freight agents with the right tools, it’s prime hunting season. Here’s how they’re making it work.

The freight industry is definitely in a hellacious frenzy right now. “Liberation Day” has come and gone, tariffs are now in effect, lanes have cooled off, and the freight recession seems never-ending.

Many are left wondering how to navigate these turbulent times. Yet, amid the chaos, an unexpected truth is emerging: the very challenges shaking legacy freight firms are creating a prime moment for independent freight agents to thrive.

The U.S. truckload market in early Q2 2025 remains in a down-cycle marked by low spot rates and abundant capacity. National average spot rates have hovered around multi-year lows. As of late March 2025, dry van spot rates averaged about $1.98 per mile (approximately $0.07 below the February average)

Meanwhile, load-to-truck ratios (LTR) – a key gauge of demand vs. truck supply – have ticked up from their winter lows but still signal a loose capacity environment in many segments.

In a market where large brokerages are bogged down by overhead and bureaucracy, independent agents have the agility to adapt quickly and profit from emerging gaps.

Adding fuel to the fire, President Trump's recent “Liberation Day” has gone into effect, introducing sweeping tariffs, including a universal 10% import duty and heftier levies on specific countries—34% on China and 20% on the European Union.

"April 2, 2025, will forever be remembered as the day American industry was reborn, the day America's destiny was reclaimed, and the day that we began to make America wealthy again," Trump said in his tariff announcement.

The immediate fallout has been mixed: in some areas, shippers rushed to move goods before duties hit, temporarily boosting freight volumes on certain lanes. For instance, produce importers accelerated cross-border shipments from Mexico in late March – reefer load postings jumped 28% week-over-week in McAllen, TX and 16% in Laredo as produce buyers tried to get inventory in under the wire.

As of writing, most “reciprocal tariffs” have been put on hold, except goods from China which were hit harder, leading to a combined 125% tariff rate against goods from the country.

The keyword right now is uncertainty, and that’s not good for the market. The tariff turmoil is fueling volatility – sudden volume surges on some lanes – but as things settle, most analysts anticipate a net drag on freight demand.

In volatile environments like this, shippers are seeking flexible partners who can think fast and reroute freight creatively. That’s where agents (backed by the right platform) can stand out.

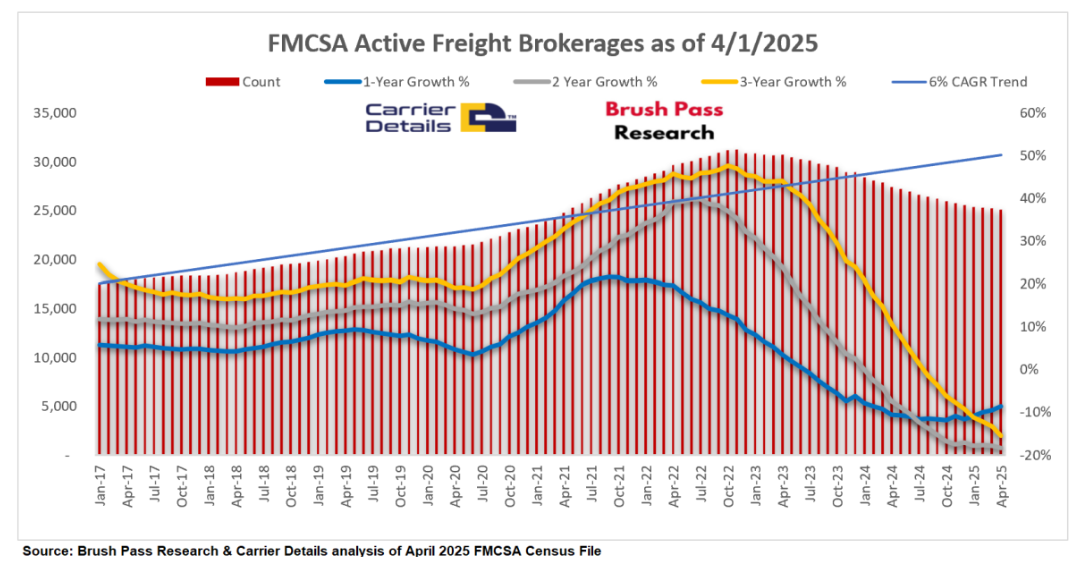

For traditional freight companies and 3PLs, the current market climate is extremely challenging and cutthroat. Soft demand and overcapacity have eroded trucking and brokerage margins for several consecutive quarters.

The bottom line is that big brokers must now do more with less, leaning hard on tech and efficiency while waiting for volumes to rebound.

Adding to the pressure, competition is intensifying from new angles. Large shippers and retailers are insourcing brokerage functions to cut out the middleman. A prime example is Walmart’s entry into the freight brokerage arena. In March 2025, Walmart began onboarding select trucking carriers into its own 3PL network.

Essentially, a giant like Walmart can afford to move freight at slim margins (or even as a loss leader) to gain market share, something that threatens to undercut smaller brokerage outfits who can’t match those volumes or prices. Other mega-shippers (Amazon, Home Depot, etc.) have similar logistics programs, further squeezing independent brokers.

Additionally, retailers’ logistics arms often pay carriers slowly (Walmart reportedly has 90+ day payment terms for some carriers), and yet many carriers sign on because the freight is steady.

While big brokers are bogged down, independent agents with lean operations and the right support can pivot faster and compete smarter, without needing the scale of a Walmart to stay profitable.

This is why we’re seeing a surge in W-2 brokers going independent: when the market’s this tough, agents with high-paying programs and fewer constraints can seize more upside.

Unlike big brokerages that are tightening up and adjusting to the current market, independent agents are in a unique spot to move differently — and move faster.

When you’re not stuck in the layers of approvals, legal matters, and corporate red tape, you can actually pivot within the market. That kind of flexibility matters, especially when certain lanes go cold and others suddenly light up.

One of the most stark contrasts in this industry right now is the earning potential of a W-2 brokerage employee versus an independent agent (1099 contractor). Let’s take a look at the contrasts:

W-2 Freight Brokers

Independent Freight Agents

It’s worth noting that the first year or two as an independent can be lean as you build a customer base – the W-2 role provides a safety net during that learning period.

But over the long run, the financial “ceiling” is much higher as an agent. The math speaks for itself: keeping 60-70% of the profit on each load, versus perhaps 15% as a W-2, means an agent with even a moderately sized book can equal the salary of a W-2 broker with a far larger book.

These headwinds are exactly what tech-forward agent programs like Freight Flex were built for: They give agents the tools, pay, and support to not actually grow in a market like this one. Here’s what you can find with Freight Flex:

Better Tools

No need for agents to invest in their own systems because they get enterprise-level tools out of the box.

Better Support

Fast Pay & Fewer Hassles

Freedom + Community

By removing the pain points of going independent, Freight Flex is turning agents into lean, well-equipped freight pros who can compete with the biggest players and win.

If you're tired of capped commissions, office politics, and slow paychecks, it's time to make your move. Freight Flex gives you the tools, tech, and take-home pay to build a book your way.

Shoot them a message at FreightFlex.com/agents and find out how much more you could be making. In a market where the old rules no longer apply, it’s time to bet on yourself (with a partner that’s built for today’s freight reality).

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).