🎣 California's Non-Dom CDL Standoff

Plus: rail merger pushback grows, USDOT expands English proficiency enforcement into rail, a major cargo fraud case, and more in today's newsletter.

Amid economic uncertainties, the 2023 holiday season sees a mix of record spending projections and retailer caution.

As the 2023 holiday season approaches, a complex picture emerges: one of record spending projections juxtaposed with retailer caution. Here's an in-depth look:

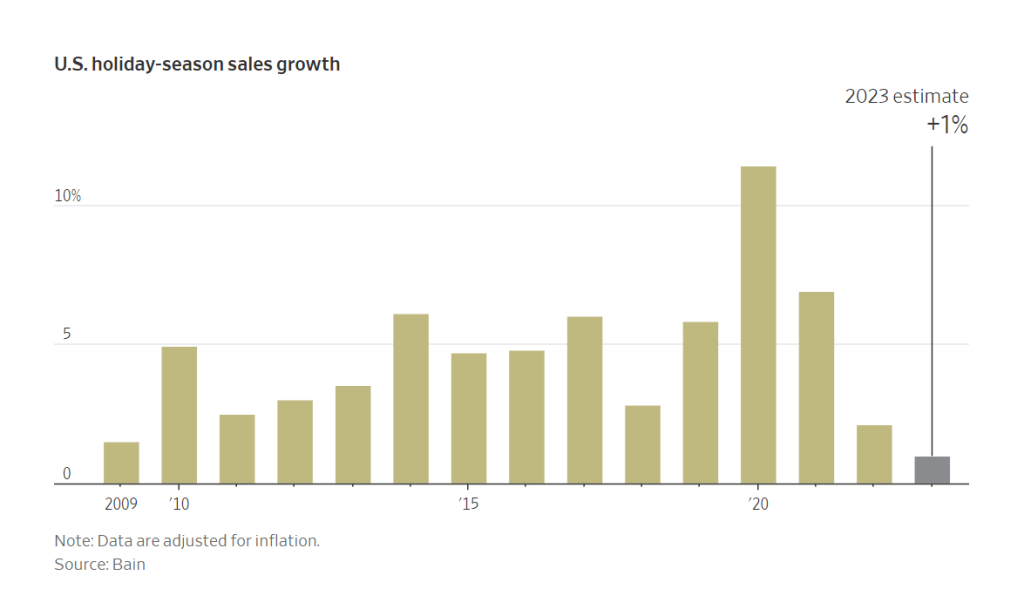

Spending Projections: According to the National Retail Federation (NRF), holiday spending is expected to grow 3-4% over 2022, reaching an estimated $957.3 to $966.6 billion. This pace aligns with pre-pandemic trends and is significantly lower than the surge witnessed in recent years.

Consumer Resilience: Despite inflation and economic agitation, consumers exhibit resilience. The average planned holiday spending stands at $875, an increase of $42 compared with a year ago.

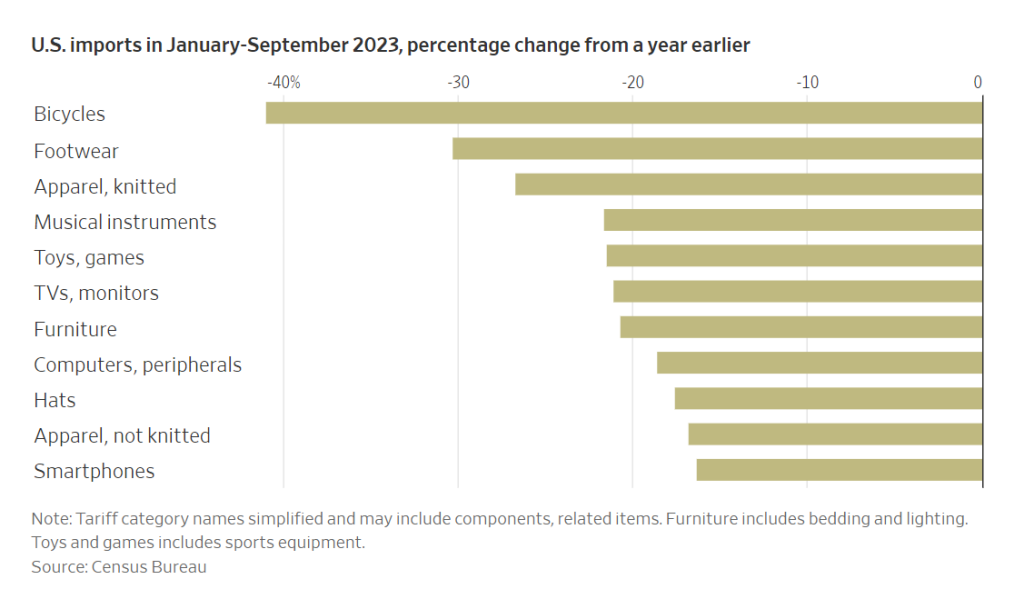

However, this anticipated spending spree is tempered by retailers' apprehensions. The CNBC Supply Chain Survey highlights retailers' concerns about weak consumer spending and potential recession risks. Big box retailers like Target have noted a reduction in consumer spending, even on essentials like groceries.

In summary, the 2023 holiday season is shaping up to be a period of contrasting dynamics: promising spending levels driven by consumer eagerness for value against a backdrop of retailer caution and economic unpredictability. This dual narrative will define the logistics and retail landscapes, influencing everything from inventory management to shopping patterns.

Hold Off the Big Christmas Splurge, Bargains Will Be Better Later@FreightAlley @tyillc @RobMcNealy

— Mike "Mish" Shedlock (@MishGEA) November 11, 2023

Christmas season rates to be dismal according to shipping analysis. And the economy is iffier than most think. https://t.co/PBQp9ivYO4 pic.twitter.com/h8ipzjqB7x

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).