🎣 Freight Alley Trip Recap

Join us as we sit down with Grace Maher and Reed Loustalot for a Freight Gong Friday recap.

Only 49% of shippers are satisfied with 3PL IT capabilities. Good news: 63% are open to working with smaller, specialized, or regional 3PLs.

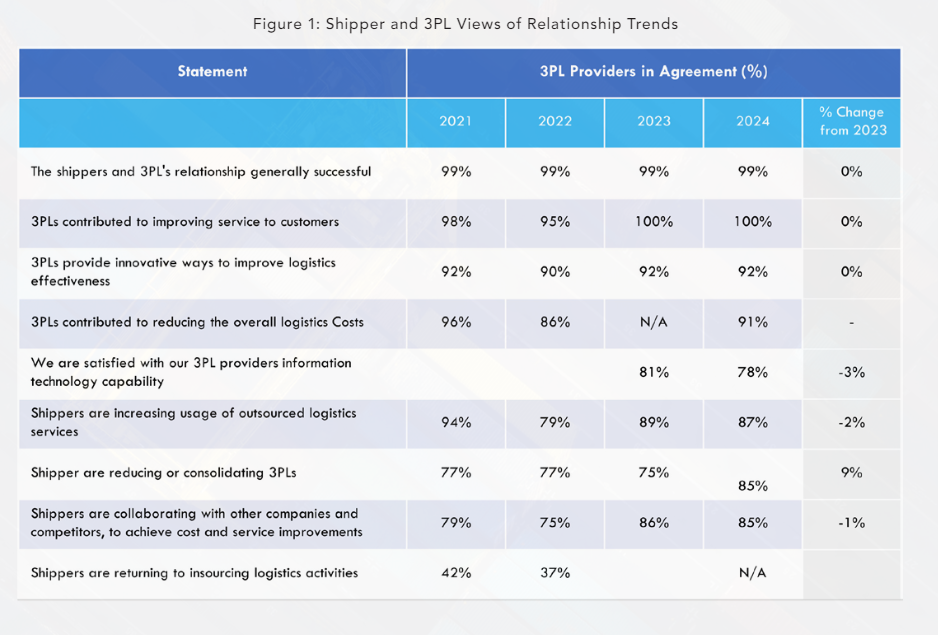

The 28th Annual Third-Party Logistics Study by Penske, NTT Data, and Penn State provides a comprehensive overview of the current state of the logistics market, focusing on the evolving dynamics between shippers and 3PLs.

This year's study sheds light on several critical aspects, from collaboration trends to reasons for declining RFP opportunities.

Positive Relationships and Outsourcing Trends:

According to the study, 95% of shippers and 99% of 3PLs report their partnerships are successful. These relationships have led to significant benefits:

Warehousing tops the list of outsourced activities, followed by domestic transportation, customs brokerage, and freight forwarding. However, IT services and customer service are less frequently outsourced, highlighting a focus on tactical over strategic tasks.

Outsourcing and Consolidation:

Shifting Power Dynamics

The past few years have seen a shift in power dynamics between shippers and 3PLs:

The Importance of Data

Data sharing between shippers and 3PLs is crucial for optimizing supply chain performance. However, challenges remain:

Smaller and Specialized 3PLs:

This data equips freight brokers and 3PL professionals with an in-depth understanding of current market trends and shipper expectations. By leveraging these insights, industry players can make informed decisions, foster stronger partnerships, and drive innovation to stay competitive for the future.

Source: Third-Party Logistics Study from Penske/NTT Data/Penn State

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).