🎣 Old Dominion's Thoughts

Here is another round-up of the most engaging and talked-about freight content from around the web and from us.

Plus: DAT map shows rate declines nationwide, Arkansas wants to mandate English proficiency tests for CDL, Class 8 orders crash, and more.

Happy Hump Day. In today's feature story, we're breaking down the latest news on one of 2024's biggest bankruptcy stories: KAL Freight. Drivers fear a sudden shutdown, creditors scramble to settle debts, and allegations of fraud taint the reputation of the company.

Plus:

TOP LANE MOVERS POWERED BY GREENSCREENS.AI

🐔 WHAT’S COOKIN’ IN FREIGHT

🤷♀️Where Are The Loads? According to DAT Market Conditions, the U.S. freight scene is on ice. The majority of the map, excluding two key southern parts of Texas, is blue. Many have been left reeling because of this decline, with some commenters on an Instagram post on the matter stating they are at a “30-50% loss right now from last year.” While some preach patience, many do not feel optimistic about the current state of freight. Furthermore, Kary Jablonski, DAT, posted data on her LinkedIn showing that while Canadian spot market freight inbound from Canada to the U.S. rates are normalizing, the volumes have “fallen off a cliff” within the last week. With so much optimism for change heading into 2025, it seems darkness is still looming over the freight industry.

📃 Arkansas Cracks Down on Non-Citizen Truck Drivers. Arkansas lawmakers introduced the Secure Roads and Safe Trucking Act of 2025 (HB1569) to tighten regulations on non-citizen commercial drivers. The bill mandates a U.S.-issued CDL and English proficiency to operate commercial vehicles in the state. Violators face $5,000 fines, vehicle impoundment, and felony charges for accidents. Trucking companies hiring ineligible drivers could be fined $10,000. Canadian CDLs will no longer be recognized. A truck driver celebrated the law (reposted via Wall Street Apes), applauding Governor Sarah Huckabee Sanders for prioritizing American documentation and English-speaking capabilities. Gord Magill also supports the move, even going so far as to state why the viral clip shows that the bill “is important.” The bill is currently under committee review.

📉 Class 8 Truck Orders Plummet. North American Class 8 truck orders fell 34% year over year in February, totaling 18,300 units, reflecting ongoing market instability. Analysts cite tariff threats and impending emissions regulations as key factors dampening demand. ACT Research reported the lowest seasonally adjusted orders in nearly two years, while FTR Transportation Intelligence noted a 38% year-over-year decline. The uncertainty surrounding trade policies and economic conditions has slowed business investment, with manufacturers considering costly production shifts to mitigate tariff impacts. Dan Moyer, senior analyst of commercial vehicles at FTR, remains cautiously optimistic but acknowledges the challenges ahead. He stated that even if tariffs went away, others could still impact the industry, such as tariffs on steel and aluminum, thus making “strategic changes costly, complex, and time-intensive.”

TAB-LLC is a wholly owned subsidiary of Artur Express Inc. Our asset-backed model allows our agents to explore opportunities that would otherwise be unavailable.

At TAB, we provide agents with unmatched support, leading technology, staffing options, and unlimited potential to meet their financial goals and keep the wheels turning.

What we offer:

And much, much more.

“There is no viable ongoing business; there is no income; and there is no liquidity to further maintain the status quo.” – The Committee of Unsecured Creditors

The California-based trucking company, once a fast-growing mid-size carrier, is now in the middle of a financial meltdown, complete with fraud allegations, lawsuits, and a bankruptcy process that could leave drivers and creditors in the dust.

Founded in 2014, KAL Freight quickly grew into a mid-sized powerhouse with:

But this aggressive expansion came at a cost—one that became unsustainable as freight rates tanked post-pandemic.

In December 2024, KAL Freight filed for Chapter 11 bankruptcy (a reorganization process that allows companies to restructure their debts while continuing operations), blaming market conditions. But court filings revealed far deeper problems, including allegations that KAL Freight:

Major creditors like Daimler Truck Financial Services and Bank of America claim fraudulent financial practices and are fighting for control of the company's remaining assets.

Bankruptcy court documents showed the company owes $325M to creditors.

From KAL Freight’s Own Attorneys:

“[KAL Freight] has been the subject of various allegations of malfeasance, including that certain personnel improperly moved trucks and trailers from the United States to Canada, improperly titled vehicles, and engaged in inappropriate accounting practices...These allegations, some of which were made public in a pending lawsuit, along with the Debtors’ financial difficulties and payment defaults, caused certain creditors to take legal action against the Debtors, including noticing defaults, and initiating foreclosure proceedings.”

From Daimler Truck Financial Services:

“KAL Freight delivered Daimler titles for the trailers and made monthly payments on the loan as if it bought and received the equipment...The deals have placed the recovery of about $40 million in Daimler loans in serious doubt.”

The bankruptcy has created anxiety for KAL Freight’s drivers, many of whom are long-haul operators scattered across the country.

In past trucking bankruptcies (e.g. the sudden collapse of Celadon in 2019), drivers were infamously stranded mid-route with fuel cards shut off, unable to get home.

Fearing a similar scenario, stakeholders have been vigilant to prevent chaos if KAL Freight ceases operations abruptly. So far, during the Chapter 11 process, KAL’s trucks have continued to run under DIP financing, meaning drivers are still hauling loads and being paid.

Creditors are now scrambling to recover funds, with two possible outcomes:

KAL Freight has been forced to appoint independent directors and a Chief Restructuring Officer, a sign that its founders have lost control of the company’s fate.

KAL Freight’s implosion is part of a larger industry shakeout, as high-interest rates, weak freight rates, and overleveraged trucking firms push more carriers to the brink. The fraud allegations, if proven, could tighten lending standards across the sector, making it harder for struggling carriers to stay afloat.

For now, KAL Freight is on borrowed time. Whether it restructures or folds completely, the industry is watching—and so are its unpaid drivers.

Sources: FreightWaves | WSJ | Financier Worldwide | Soap Central/MSN

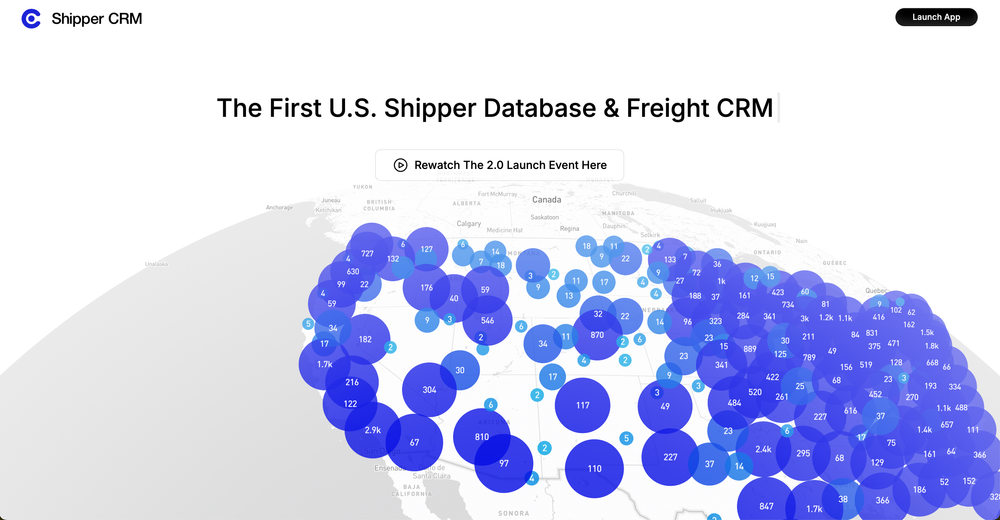

Stop wasting time searching for shippers—Shipper CRM (a FreightCaviar product) is the fastest way to find the shippers you should be working with.

ShipperCRM offers four key features:

🌎 AROUND THE FREIGHT WEB

🤔 Carrier Considers Sale. Family-owned Gray Transportation is exploring a potential sale amid shutdown rumors. “We’re working with our customers and the buyer,” Company President Darrin Gray told FreightWaves in an interview. The company has over 160 trucks, 500 trailers, and 100 drivers.

📉 Trucking Stocks Decline. Trucking stocks have tumbled recently; however, analysts at Citi view this downturn as an opportunity, seeing it as a sign of market stabilization. However, they warn that weaker consumer spending and sluggish industrial output could delay rate recovery.

❌ Flatbeds Rejections. The first week of March has seen a surge of flatbed tender rejection rates are “off to the moon!” according to Thomas Wasson. As Craig Fuller stated in a response, maybe there are “better options for carriers…”

📊 ArcBest’s TL Freight. To address declining less-than-truckload volumes (down 2% YoY in February and a 9.2% decline in January), ArcBest has increased its truckload freight operations “to better utilize empty capacity and target higher operating income.”

👚 Kohl’s Shares Fall. Kohl’s anticipates a larger-than-expected drop in annual sales, citing weak consumer demand and shifting shopping trends. Quarterly sales fell 9.4%. Ashley Buchanan, Kohl’s CEO, stated that most of the current issues were “self-inflicted” over the past years.

🦜 Bird & Poultry Seizures. Since October, customs officers have conducted 3,768 bird- and poultry-related product seizures across all U.S. borders. 352 fentanyl seizures have been conducted under this same time frame.

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT HUMOR

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).