🎣 Trump's Tariffs Weekly Recap

Plus: LAPD busts a $3.9M cargo theft ring, Nuvocargo and UPS expand in North America, U.S. moves to ease rules for self-driving trucks, Funny Freight Friday, and more.

Explore the state of U.S. port volumes and the rise of industrial vacancy rates in 2Q 2023.

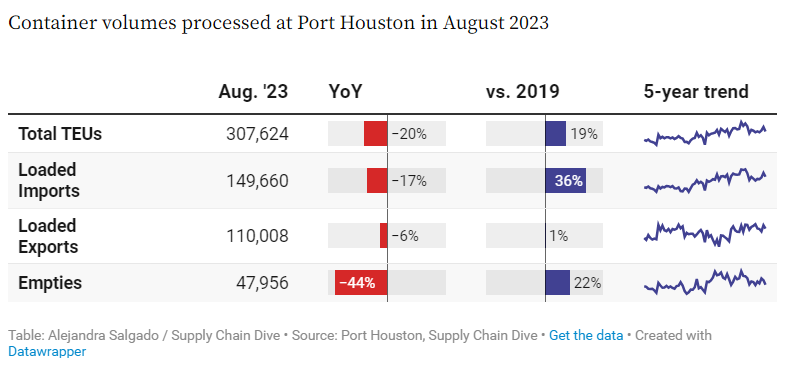

Cargo volumes at Port Houston saw a significant 20% year-over-year decline in August, hitting 307,624 TEUs, marking the highest drop of the year. Last year's August recorded a record-breaking 382,842 TEUs.

Despite the decrease, the port remains stable, with ongoing investments in infrastructure. Port Houston's chairman, Ric Campo, emphasized the commitment to both waterside and landside improvements. July had been the busiest month in 2023, handling 344,163 TEUs, while May marked the lowest point at 300,482 TEUs.

Port of Los Angeles Thrives:

Port of Long Beach Struggles:

Port of Oakland's Economic Impact:

CBRE's 2Q 2023 Port Watch report reveals a 3.5% rise in seaport market vacancies and a 4.6% increase in inland port markets. However, seaports like Charleston, Los Angeles, Oakland, and Portland maintain low vacancy rates. Inland port markets saw the highest net absorption at 60.4 million SF, followed by non-port markets at 59.6 million SF and seaport markets at 24.3 million SF. North American port container volumes decreased by 18.6% YoY, but Manzanilla, Mexico, and Lazaro Cardenas experienced growth due to nearshoring.

Sources: ALM Globest | Supply Chain Dive | Transport Topics

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).