🎣 Freight Alley Trip Recap

Join us as we sit down with Grace Maher and Reed Loustalot for a Freight Gong Friday recap.

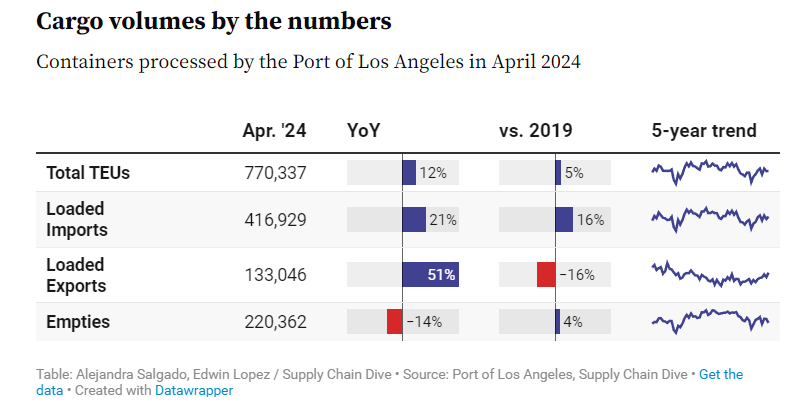

Plus, the Port of Los Angeles posted its 11th straight month of year-over-year gains in exports, processing 770,337 total TEUs, up 12% from last year.

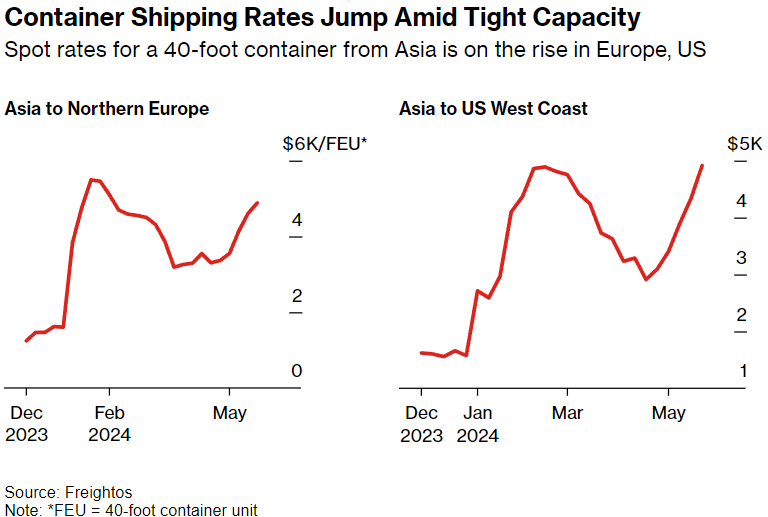

Global goods trade is bouncing back after last year’s slump, pushing up shipping rates and straining capacity. This trend brings back memories of the "Covid-19" chaos when skyrocketing freight rates and disrupted supply chains dominated the headlines.

“This situation will bring back memories of the chaos and sky-rocketing ocean freight rates during the pandemic. Shippers have learned lessons from Covid-19 and some are bringing their imports forward, ahead of the peak season and the potential for a capacity squeeze.” – Emily Stausbøll, a senior shipping analyst at Xeneta.

John McCown, a veteran shipping analyst, highlighted the strong gains in container imports, attributing them to underlying economic activity.

In April, the Port of Los Angeles posted its 11th straight month of year-over-year gains in exports, processing 770,337 total TEUs, up 12% from last year.

Total imports rose 21% YoY, with exports up 51%. Daniel Hackett from Hackett Associates noted that while the West Coast shows stronger growth, year-over-year growth rates are expected to slow in the second half of the year compared to the first half.

On Pre-Pandemic Comparisons:

“Pre-pandemic comparisons are tricky. Comparing 2019 to 2024, the growth on the West Coast is just a 5% increase, whereas the East Coast saw a 14% increase. Peak season forecasting has become less predictable due to changes during the pandemic.” – Daniel Hackett, Hackett Associates

Sources: Bloomberg | Supply Chain Dive

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).