🎣 Freight vs. Tariffs

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

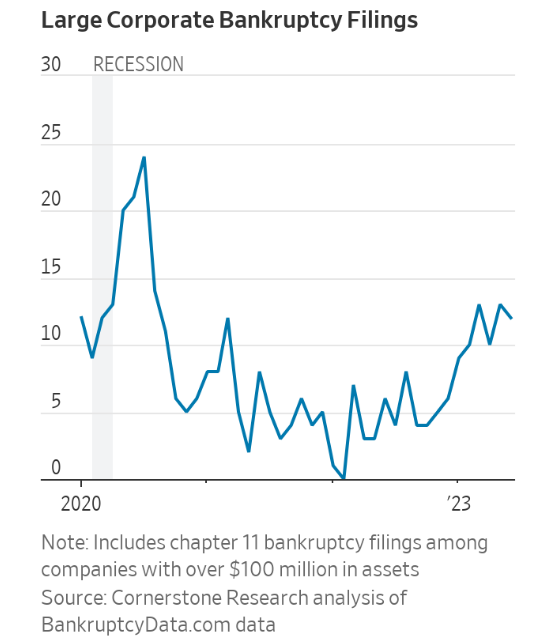

Exploring the rise of mega bankruptcies and the decline of DTC brands in 2023. What do these financial challenges signal for the broader economy?

In a year marked by uncertainty, businesses of all scales are navigating treacherous waters. Major corporations, from SVB Financial, Bed Bath & Beyond, and even the trucking giant Yellow, have sought chapter 11 bankruptcy protection. Their reasons?

Large-scale business bankruptcies, often referred to as "mega bankruptcies," are not merely indicators of corporate distress but also significant red flags for the broader economy.

However, these corporate struggles aren't limited to traditional sectors. DTC (Direct-To-Consumer) businesses are also feeling the heat. Two major public DTC companies—Smile Direct Club and Blue Apron—have recently declared bankruptcy or sold for a fraction of their peak valuation.

Further analysis of public DTC brands reveals several others, including Allbirds and Purple, that check similar boxes of unprofitability and declining revenue, painting a concerning picture for their future.

Sources: WSJ | Ben Cogan/LinkedIn

…⏰💣

— Prodigal (@ProdigalThe3rd) October 8, 2023

Big-Company Bankruptcies Rising Briskly

Chapter 11 filings estimated to have tripled during the first half of 2023 from one year ago

“Mega bankruptcies,” filed by companies with +$1B in assets hit 16 in first half of 2023 versus 17 year average of 11 for that same… https://t.co/XNCwc9uSMq pic.twitter.com/8GViERji3m

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).