🎣 Freight vs. Tariffs

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

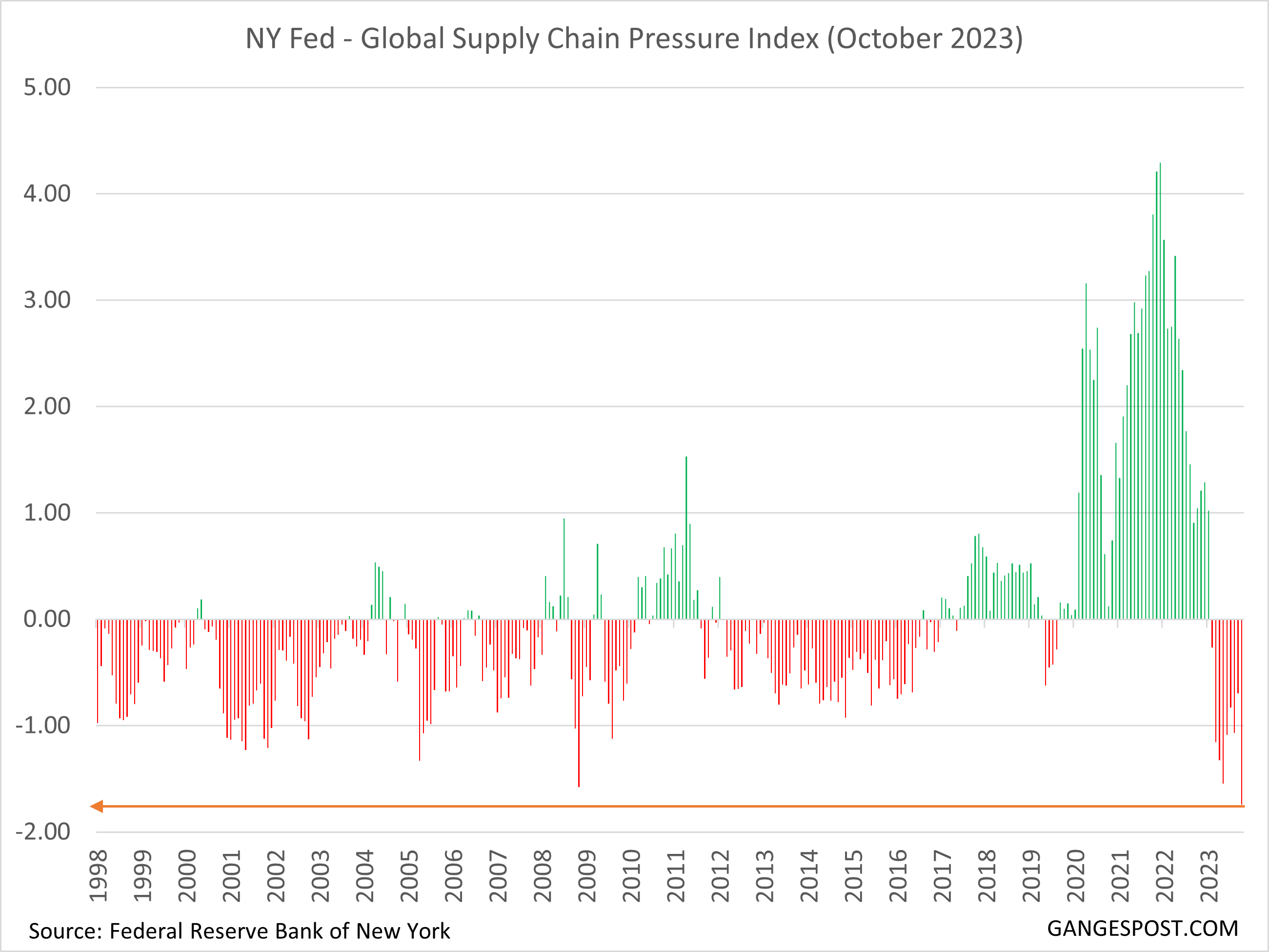

Explore how the NY Fed's Global Supply Chain Index hit a 26-year low, signaling eased logistics and potential shifts in the trucking industry.

The most recent data from the New York Federal Reserve's Global Supply Chain Pressure Index (GSCPI) reveals significant developments in global logistics.

Key Highlights:

Understanding the GSCPI:

Components of the GSCPI:

Think of the GSCPI as a "health check" for the world's supply chain. A lower score means things are moving more smoothly - goods are being transported more efficiently, and it's costing less to do so.

Implications:

The easing of global supply chain pressures, indicated by the lower GSCPI, can have mixed effects on the U.S. trucking industry, particularly for owner-operators and freight broker

Expert Insights on the GSCPI Data

Here is the NY Fed's "Global Supply Chain Pressure Index". It is at the lowest level in the last 25 years. Two things come to mind:

— Ganges Post (@theGangesPost) November 12, 2023

1. Supply chain issues have now all but been resolved.

2. But since it is even lower than during GFC, is it telling us that "stuff" is not moving? pic.twitter.com/roln3LHNUd

Massive capacity overbuild during COVID.

— Craig Fuller 🛩🚛🚂⚓️ (@FreightAlley) November 12, 2023

Procrastinators rejoice:

Ordering holiday gifts at the last minute will work wonderfully this season, as the logistics industry has plenty of excess capacity to handle it https://t.co/ikHAbxPxW1

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).