Why Now Is the Best Time to Be an Independent Freight Agent

The market’s brutal, sure, but for freight agents with the right tools, it’s prime hunting season. Here’s how they’re making it work.

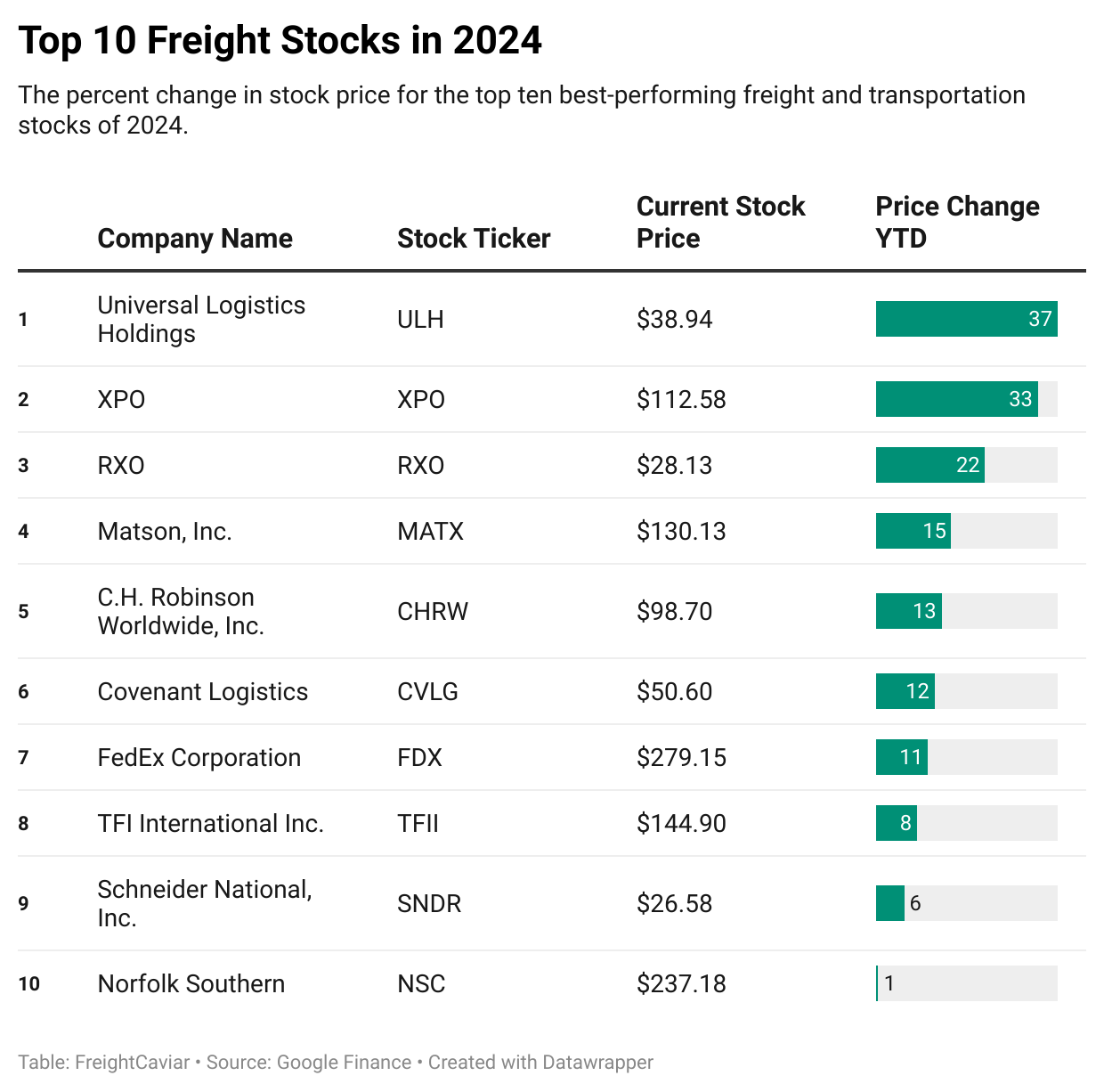

The best-performing freight stock of 2024 might surprise you.

Good morning. We’re trying something new today—a Tuesday newsletter with just one feature story. We’d love to know what you think about it. If you have a couple of minutes, we’ve put together a quick survey to get your thoughts. Click here to take the survey.

TextLocate makes it easy for brokers to communicate directly with drivers via SMS-based text messaging—no app to download—without having to use personal communication devices.

Features like 2-way text chat, one-time location updates, and image capture (think BOLs and PODs) all inside a simple dashboard give brokers the quick updates they need to make better decisions about freight.

2024 didn't get off to a great start. The market continued to be battered by persistently low freight rates and overcapacity. Demand wavered, and the supply chain grappled with global tensions, reroutes, downed bridges, and droughts.

Despite some glimmers of recovery, many companies are struggling to maintain profitability. Freight rates have stubbornly remained at historic lows, a stark contrast to the surge seen during the peak of the pandemic-driven supply chain crisis. Overcapacity, a persistent thorn in the industry's side, has made things worse, leading to fierce competition and shrinking margins.

Still, a few freight stocks have managed to defy the odds, posting some pretty decent gains in 2024. This list highlights the top movers in this fiercely competitive market.

This time last year, we published a similar article on the top freight stocks, and there was a lot more to celebrate back then. Bigger gains and a few different names at the top. You check it out by clicking below. 👇

What did you think of today’s shorter newsletter with just one feature story? We’d love to hear your thoughts! Share your feedback by taking our quick 2-minute survey using the link below.

If you’d prefer to unsubscribe from our Tuesday and Thursday newsletters and stick to just the regular Monday, Wednesday, and Friday editions, you can easily update your email preferences in your profile at FreightCaviar.com.

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).