🎣 Chameleon Carrier Tied To Crash

Plus: Trump extends tariff deadline to August 1, new tax bill includes wins for trucking, and the DEA seizes 700 lbs of meth from a semi in Georgia.

At FreightCaviar, we believe it’s always important to look ahead and plan for the future. That’s why we’ve gathered exclusive freight market forecasts from top logistics executives for the year 2023. These experts will examine truckload demand and capacity trends from the past in order to make informed forecasts about the future of freight. They’ll also discuss the impact of these trends on businesses in the logistics industry. Get ready to dive deep and find out what the future holds for freight rates in 2023!

Tim Higham is the President and CEO of AscendTMS, the largest TMS with 51,619 active customers. Higham’s software gives him live and real-time access to key information needed to give accurate forecasts.

Jake McLeod is the COO at EXO Freight, the world’s first open deck transportation marketplace driven by technology. McLeod has been in the industry for about 15 years and has seen the worst market (2008/09), an insanely high market (2021), and everything in between.

William Kerr is the President of Edge Logistics, a company that’s been recognized for its record-setting growth. Kerr was named one of Crain Chicago’s 40 under 40, which honors company leaders who have successfully improved the world through their endeavors.

We’ve also got input from the CEO of a Leading 3PL, who wishes to remain anonymous.

We’ve got to take a moment to look back. The buzzword of 2020-2021 was unprecedented, and it’s the perfect way to describe the freight market at the time. Such high rates weren’t normal – and this attracted a lot of newcomers and hurried decision-making.

CEO of Leading 3PL: I will say that a lot of our industry is historically not great at thinking long-term. We see companies make decisions that help them most today, here and now, without concern for long-term success and stability. I think some companies overcommitted themselves with hiring, unsustainably lucrative compensation packages…and other short-sighted decisions. As things have turned the other direction in the market, these same companies were forced to make unfortunate hard decisions. Starts with layoffs. When that’s not enough, things get bleaker. We saw a lot of that in the second half of 2022.

McLeod: Unfortunately, thousands (hundreds of thousands) of new carriers and owner-operators entered the market during this time and have no idea what normal rates look like, have never run a business properly before, overpaid for equipment, and could generally run a company that was profitable despite not being particularly well operated. Now that the tide has gone out, we are seeing who is swimming naked, and it is a lot of the industry – these carriers are going to be in desperate times to try and make their business work, or they will exit (voluntarily or by going out of business).

Higham: Amazingly, most people under the age of 35 haven’t experienced a real recession since they’ve been employed. But they’re about to, and it won’t be pleasant.

As for 2023, here’s what the experts had to say.

Higham: I can literally see, in real-time (because of the 51,593 companies that use AscendTMS every day to run their logistics & trucking operations), the rapid downturn in rates on every load, the fewer viable freight companies out there, the lower total staff being employed at each entity, the lower number of trucks running, the lower TL and LTL volumes being moved, and the incessant squeeze on gross margins. These aren’t guesses, these are the real actual experiences of freight brokers, asset carriers, and shippers every single day.

Kerr: We will see a slower January and early February than last year, and then in late February/early March when most of the drop/drop shipper-national carrier rates reset to the 2023 rates, we will see the live/live spot market creep back up to a positive spot market through the summer and into peak season. By positive, I mean I expect that spot rates will be incrementally higher than contract rates on aggregate of live and drop pricing. That is not to say that we will have an inflated or accelerated spot market, I do not think that will occur in 2023 except in short bursts, regionally.

McLeod: What we are seeing is honestly a return to “normal” – the truckload market rates we saw in late 2020, 2021, and early 2022 were not normal or sustainable and truly a bubble (much like everything mentioned previously). While carriers scramble for business, they will take freight for cheaper and cheaper rates, as there are fewer and fewer load opportunities available as production slows, spending slows, etc. At some point, (I keep hearing from people Q1 or Q2 2023, I think it will be closer to 2024,) rates will hit a bottom and then likely bounce up a bit before settling into a normal market rate again (which I think is still lower than we are seeing truthfully). This will be due to capacity crunching again, consumer confidence and spending increases, and an overall increase in economic activity.

To summarize the report from Arrive Logistics, freight rates in 2023 are expected to be more stable compared to the previous year, with long-term contract rates returning to more typical levels. There may be less demand for shipping services, leading to more available capacity and making it easier for companies to stick to their preferred shipping routes.

However, there may be fewer shipping options available in the first half of the year due to a decrease in capacity, which could leave the market vulnerable to disruptions. There is likely to be less capacity available in the market due to high contract rates forcing some owner-operators and small companies out of business. However, this decrease in capacity may be offset by the influx of capacity that entered the market in the past and strong routing guide compliance.

Demand for shipping services may be impacted by a cooling economy and lower consumer spending, but demand may be supported by the need to fulfill backlogged orders in manufacturing and other industries.

These market forecasts are important because they shape how businesses will move in the environment until a new pattern arrives. Of course, nothing can be said for certain, but smarter leaders will adjust their behavior accordingly. The experts give their thoughts on how the trends will impact logistics companies.

Higham: Massive cost cutting will be needed by a massive number of companies in 2023 (and, if you have a big salary that was negotiated during the excesses of late 2020, 2021, or early 2022, watch out). But, every recession can also be an opportunity. Those companies that prepared for the inevitable “rainy day” will manage to stay solvent, and they’ll pick up the customers of those that don’t.

CEO of Leading 3PL: If the trend continues with volumes and rates declining, things will get much worse for that same set of companies[who made short-sighted decisions]. I think right now, there’s a lot of “holding on”, trying to make it through the downturn. If this lasts long enough, those short-sighted companies won’t have the resources to sustain themselves. Hopefully, things turn around soon and business booms again. But if not, things will get uglier before they get better.

McLeod: I am not a doomsayer or getting political by any means either just being real with what I see happening, what I have seen happen, and where I think we are heading and where we are at. 3PLs/Brokers are not immune to this either, as we have seen thousands laid off in the last few months from many of the major players, and I am sure plenty we have not heard about from the medium and small players, not to mention the most recent news from CHR)

There’s a consensus that in 2023, companies will be more risk-averse, in addition to looking for any way to cut costs. This could be a good opportunity for those looking to gain new business. Long-standing partnerships may not be holding as strong when it comes to keeping a company afloat.

Higham: Freight executives are looking to save money right now, and they’ll give their business to those that can show instant ROI. In 2023, people will be more interested in securing cost savings than ever before, and so they’ll finally be willing to go through the pain of switching providers to realize those savings.

So, there could be room for growth and innovation, particularly regarding freight sales technology. Any tool or service that can streamline processes or lower operating costs might have a good year. Our experts discuss why businesses like theirs are in a prime position to take advantage of the coming market conditions.

Higham: Freight sales technology will be at the forefront this year, like ShipperCRM, to secure more (and better) shippers, high-value TMS, like AscendTMS, to eliminate TMS costs, and more automation, with freight AI, to reduce headcount. Everything a broker, carrier, or shipper uses in 2023 will be about VALUE!

McLeod: I am fortunate that EXO is at a point where we have nowhere to go but up, and we continue to capture new business opportunities from new and existing customers. We have built a better mousetrap for carriers and shippers to do business. While traditional brokerage models are not going anywhere, they will have a harder time defining their value prop as time marches onward.

Things don’t seem catastrophic, but companies will feel the pressure this year. It depends on the mindset and decisions a company made in the past that will impact its longevity.

McLeod: So while this all may sound pessimistic, I think it’s more just understanding that there was always going to be a correction coming, and if you thought that 2021 was going to be here forever and not a black swan event then you’ll be in for a really rude awakening, this is not a get rich quick industry. There are ups and downs, but there is a happy normal, and we are not far from that, but there will still be some pain to endure before we get there. Those that have built good businesses will come through better than before.

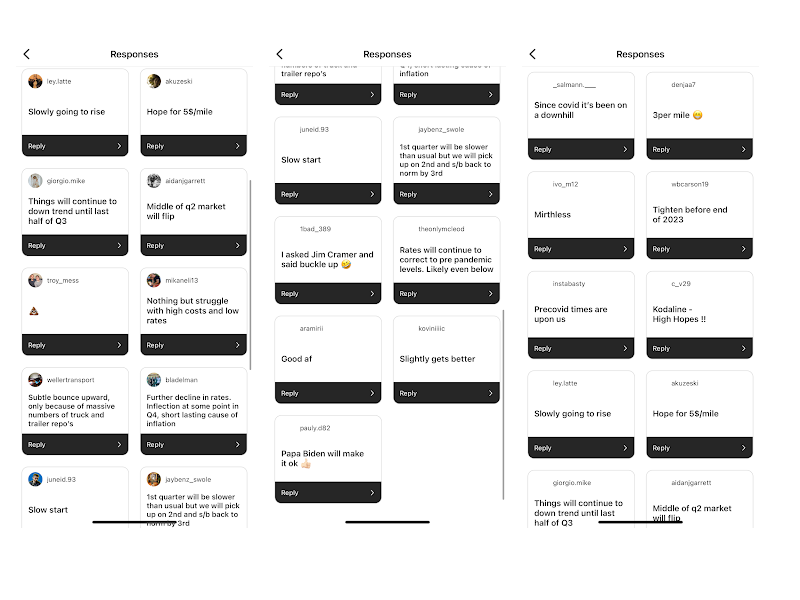

FreightCaviar’s Instagram poll brought in 1000 responses from followers, who are mostly made up of people working actively in the industry. We asked followers, “Will the market bounce back in 2023?”

Take a look at some of the written responses below.

So, of course, many external factors can make the market unpredictable. And here, experts have provided a range of predictions, from more stable rates and healthy demand to the potential for disruptions and lower capacity. It is clear that the market will continue to evolve and that businesses in the logistics industry will need to stay informed and adapt to changing conditions to remain competitive. It is important to stay up-to-date on industry trends and developments and to be proactive in planning for the future (like following FreightCaviar, for example). By staying informed and taking a long-term view, companies can be better prepared to navigate the ups and downs of the freight market in the coming year and beyond.

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).