🎣 Freight vs. Tariffs

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

Who’s up, who’s down, and who’s just holding on? We scan the freight stock battlefield for the biggest winners and wrecks.

Happy Tuesday.

The freight market’s been through it lately, and freight stocks? Even more so. But as they say, "millionaires are born in recessions" – and a freight one might be winding down (or not… looking at you, tariffs).

Today, we’re breaking down who’s thriving, who’s diving, and where opportunity might lie as we close Q1 of 2025.

I'm going to make this clear. I AM NOT A FINANCIAL ADVISOR. But I do love stocks.

The point of this article is not to give you any advice but rather to provide a general overview of what freight stocks have performed well and what haven't.

Usually, freight gives us an early insight into how the economy is doing.

Please note: prices may have changed

C.H. Robinson (CHRW)

1-Year Performance: ~+26.3%

CHRW leads with a 71.1% Q4 2024 operating income surge and a 10.4% gross profit rise, driven by CEO Dave Bozeman’s focus on tech efficiencies like generative AI. Asset-light and steady, it's thriving as freight demand slowly ticks up.

Amazon (AMZN)

1-Year Performance: ~+13.1%

Not a pure freight stock, but Amazon Freight’s logistics arm is massive. There are also LTL entry rumors that could add upside. AWS, Prime, warehousing—Amazon has all the tools to make a big splash in this fragmented space.

Union Pacific (UNP)

1-Year Performance: ~-3.6%

A rail giant with dividends and industrial exposure. But the tariff talk on Canada and Mexico isn't doing it any favors.

RXO

1-Year Performance: ~-8.6%

RXO’s brokerage model is gaining traction, especially after acquiring Coyote. Its offset revenue dips with solid EPS beats and tech-driven growth.

XPO

1-Year Performance: ~-9.3%

XPO’s LTL focus delivered margin gains in Q4 and earned a Stifel "Buy" upgrade as freight capacity tightens.

FleetWorks is an AI agent for managing your carrier network.

Fred and Felice talk to carriers over phone, email, and text. They can:

FleetWorks frees broker time to help your customers and carriers with their toughest problems.

FedEx (FDX)

1-Year Performance: ~-14.2%

FedEx is still outperforming UPS and has zero Amazon exposure, but industrial weakness and tariff uncertainty are dragging it down. A long-term play if volumes rebound.

Werner Enterprises (WERN)

1-Year Performance: ~-20.65%

High insurance claims and spot market overcapacity wrecked their Q4. A value play if demand rebounds.

J.B. Hunt (JBHT)

1-Year Performance: ~-20.8%

Tied to big clients like Amazon and Walmart, JBHT's intermodal strength is notable, but 2024's freight slump didn’t spare anyone.

UPS

1-Year Performance: ~-26%

Full disclosure: I actually own 142 shares of UPS from the Coyote employee stock program (142 shares at $98., the stock pays a quarterly dividend of $1.64). The stock's taken a hit from Amazon cutting 50% of volume in Q4 and overall freight softness. But UPS is over 100 years old, pays a solid dividend, and operates CATCH in Chicago, where up to 2% of U.S. GDP flows. Too big to fail?

ArcBest (ARCB)

1-Year Performance: ~-45%

Despite beating Q4 expectations, ArcBest couldn’t keep up with LTL peers like XPO. Bank of America lowered their price target and rated it "Underperform."

Roadrunner Transportation Systems (RRTS)

They’re back. With Prospero Staff Capital now in control and LTL growth lanes expanding, RRTS has surged. Low volume, high volatility—a pure momentum play with lots of risk. But it’s the sleeper hit if losses narrow.

[Double check on this because it's showing 0.00 price and doesn't show up on stock watchlist for 1-day]

Landstar (LSTR)

Landstar System isn’t having a great year. The asset-light logistics provider is caught in a freight funk: volume is soft, truck capacity is up, and demand just isn’t snapping back.

Its core truck transportation segment continues to slump. For Q1 2025, the company expects truckloads to fall 2–7% YoY, while revenue per load could decline up to 2%, or at best rise 3%.

Despite being asset-light and historically resilient, Landstar isn’t immune to market realities.

Earnings revisions are heading south: current quarter EPS estimates have dropped 18.4% in the past 90 days. And while 98% of its shares are institutionally owned, Wall Street’s consensus is lukewarm: 12 “Hold” ratings, 1 “Sell.”

What’s Next? The upcoming Q1 earnings report on April 29, 2025 will be a key moment. If volumes and rates don’t surprise to the upside, more downside pressure could follow.

Scoop: Still a solid company with low debt and strong financials, but Landstar is stuck in a freight cycle that hasn’t yet turned. Until demand improves, this stock looks more “Hold” than “Go.”

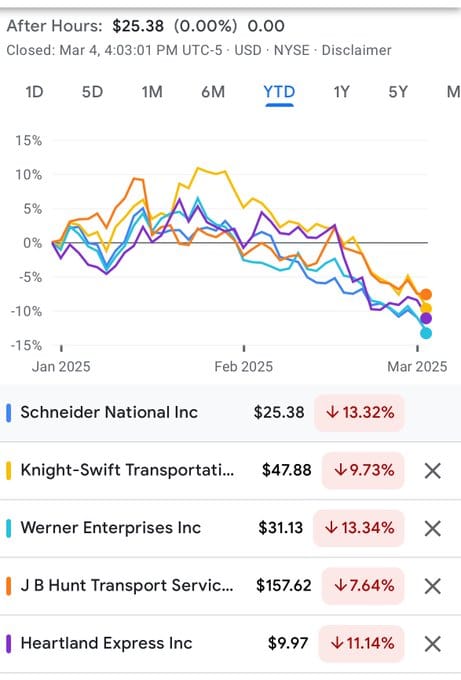

Assets have been getting crushed this year. Below is a chart of the YTD returns of some of the largest asset companies.

TAB-LLC is a wholly owned subsidiary of Artur Express Inc. Our asset-backed model allows our agents to explore opportunities that would otherwise be unavailable.

At TAB, we provide agents with unmatched support, leading technology, staffing options, and unlimited potential to meet their financial goals and keep the wheels turning.

What we offer:

And much, much more.

These are freight giants with either strong moats or big rebound potential. All of them have scale, infrastructure, and decades of freight ops under their belt.

Historically speaking, these stocks are winners. You don’t reach multi-billion market caps by doing something wrong. But as always, keep an eye on tariffs, demand swings, and market sentiment—especially in a space that tends to lead broader economic signals.

A look at freight stock winners & losers at the close of Q4 2024.

Disclaimer: This content is for informational purposes only and is not financial advice. Please do your own research or consult a licensed advisor before investing.

FREIGHT HUMOR

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).