🎣 Freight Alley Trip Recap

Join us as we sit down with Grace Maher and Reed Loustalot for a Freight Gong Friday recap.

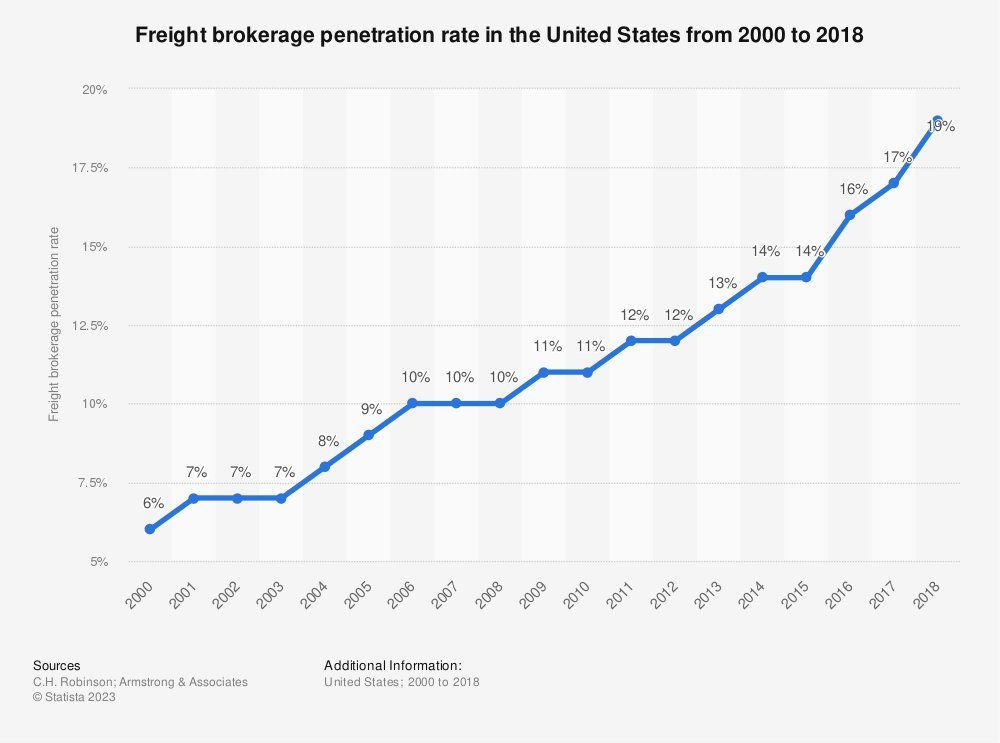

With freight brokers playing a larger role, the typical freight cycle is undergoing some major changes.

The freight brokerage landscape has undergone a shift in the past two decades. From being an industry underdog to now spearheading the direction of freight cycles, freight brokers have changed their narrative. Drawing insights from FreightWaves Founder and CEO Craig Fuller, let's break down this shift.

From Cottage Industry to Dominance

Twenty years back, freight brokers were on the periphery of the trucking industry. Fast forward to today, their influence is palpable:

As brokers began investing in technology and customer service, they outpaced their asset-based competitors. The result? They've now secured primary positions in shipper's routing guides, often outclassing their asset-based competitors.

Quality Over Quantity

The freight quality managed by brokers today is a stark contrast to that of two decades ago. In fact, today:

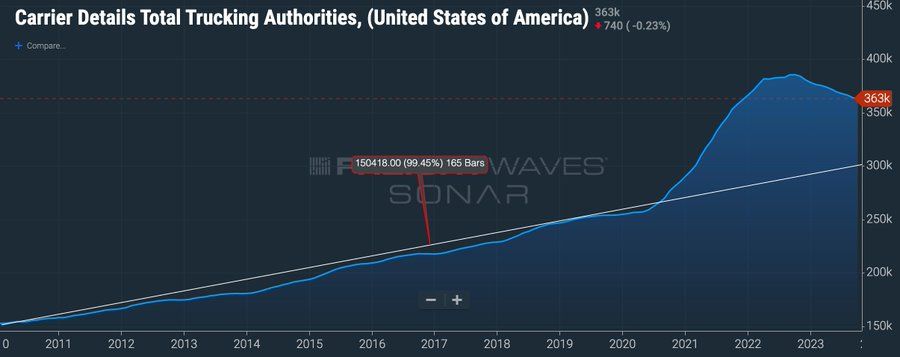

The Resilience of Small Carriers

Contrary to expectations, small carriers have proven their tenacity during this challenging period:

The Trucking Trend Line

With 78 weeks projected before the trucking market stabilizes with historical trends, the journey looks to be a slow one.

Source: FreightWaves

This is going to continue to trend down, as the capacity map resets. https://t.co/3O0CjG2kfk

— Craig Fuller 🛩🚛🚂⚓️ (@FreightAlley) October 14, 2023

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).