🎣 Chameleon Carrier Tied To Crash

Plus: Trump extends tariff deadline to August 1, new tax bill includes wins for trucking, and the DEA seizes 700 lbs of meth from a semi in Georgia.

The U.S. manufacturing sector faces contraction with a PMI of 48.7 in May 2024, while manufacturing construction hits a record high. What's up with these mixed signals?

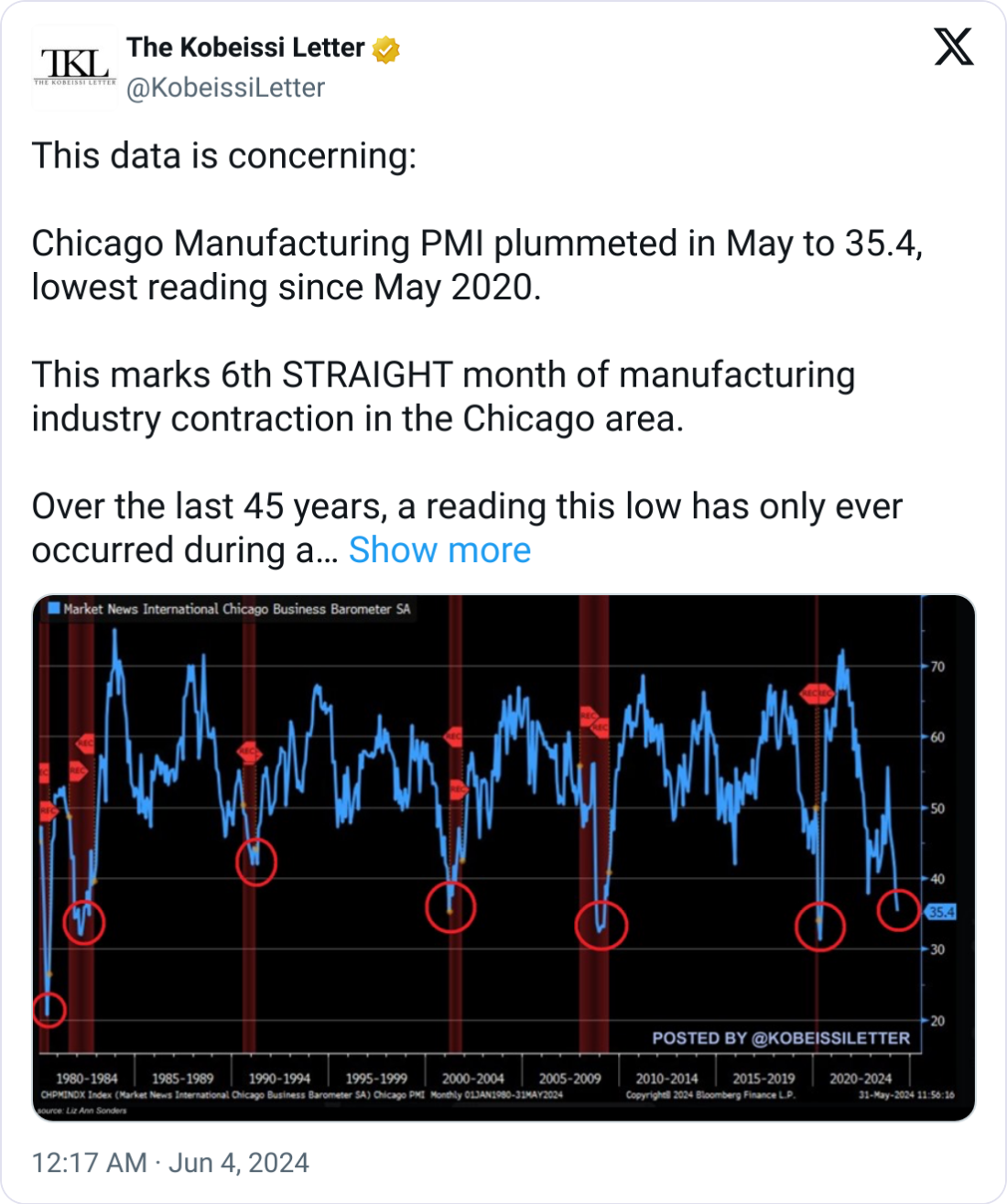

The U.S. manufacturing sector faced a contraction in May 2024, with the ISM Manufacturing PMI dropping to 48.7%, down from 49.2% in April. This indicates a faster contraction rate, driven by a sharp decline in new orders and production.

High borrowing costs, restrained business investment, and softer consumer spending are contributing factors.

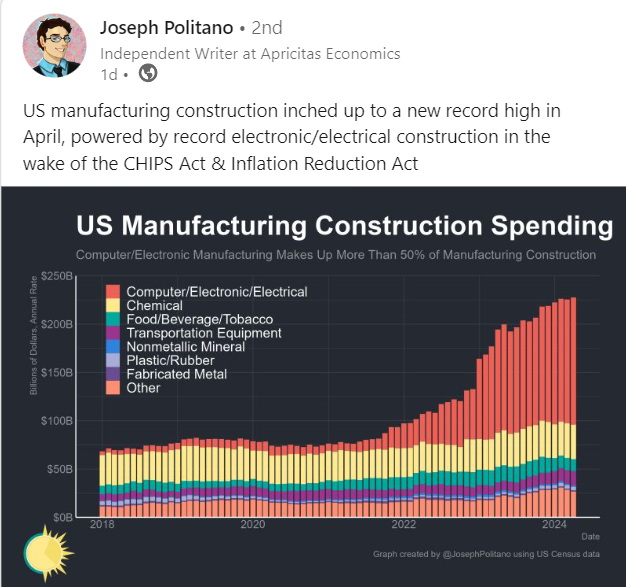

Meanwhile, manufacturing construction spending reached new highs, powered by significant investments in electronics and electrical sectors, thanks to the CHIPS Act and Inflation Reduction Act.

However, experts like Jason Miller suggest that these data might overstate actual plant construction due to declining production of construction supplies.

"I continue to believe these data, even the inflation adjusted version used by the BEA, are overstating the true magnitude of plant construction. For example, separate data for industrial production of construction supplies has been trending down since an early 2022 peak." – Jason Miller, Supply Chain Professor

Despite this growth, the Chicago Manufacturing PMI plummeted to 35.4, its lowest since May 2020, reflecting broader economic concerns.

Sources: Joseph Politano on LinkedIn: US Manufacturing Construction Inched Up | The Kobeissi Letter on X: Chicago Manufacturing PMI Drops | James E. Thorne on X: US Manufacturing Sector Contraction

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).