The Tab Count Is Killing Brokerage Margins

A practical look at how freight AI is evolving from simple automation to operational decision support, and what it means for broker productivity, tribal knowledge capture, and more.

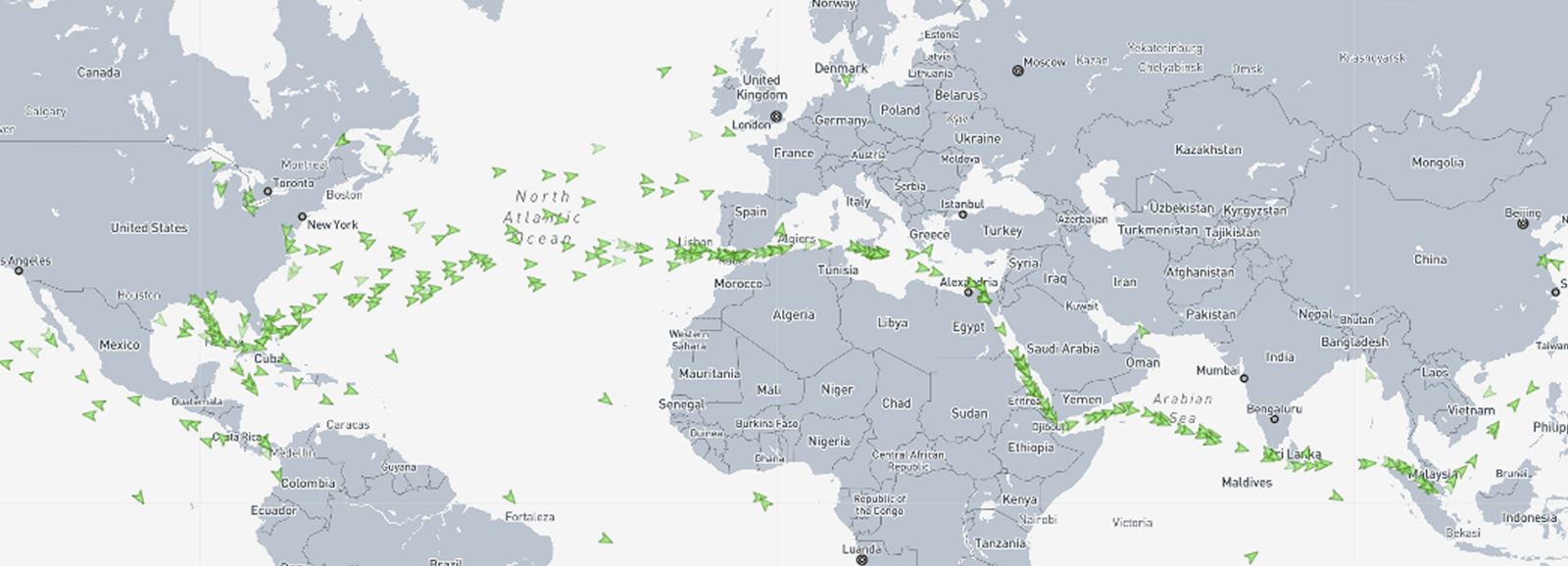

Explore the significant shift in global shipping as severe drought conditions in the Panama Canal compel dry bulk vessels, especially those carrying U.S. grain, to reroute through the Suez Canal.

The Panama Canal, a critical maritime passage linking the Atlantic and Pacific Oceans, faces ongoing challenges due to persistent low water levels. This situation has led to significant restrictions on transit capacity, reshaping global shipping and trade dynamics with disruption likely to extend well into 2024.

Restriction Timeline: The Canal Authority has progressively reduced booking slots, impacting vessel transits. The timeline shows a steady decline:

Impact on Trade Routes: These restrictions have nudged shippers towards alternative routes, particularly affecting trade between northeastern Asia and the U.S. Approximately 46% of container movement from this region relies on the canal.

Strategic Responses: The market has adapted with higher blank sailings and prioritization of lighter containers. This shift has resulted in a 2% to 10% weekly decrease in capacity from Asia to the U.S.

Moreover, the canal's bottleneck has specific ramifications for propane traders. With U.S. inventories at record highs and Asian demand surging, delays in the canal have led to significant cost implications, even prompting a shipper to pay $2.85 million to bypass the waiting line.

The constraints also coincide with the growth of the Suez Canal as a viable alternative for Asia-U.S. East Coast trade, further complicating routing decisions.

Sources: Supply Chain Dive | Detroit News | Journal of Commerce | FreightWaves

Here comes the first one @OKalleklev

— Alexander Stahel 🇺🇦🇮🇱 (@BurggrabenH) November 7, 2023

An Asia-bound LPG tanker - BW Tokyo - is headed now to the Suez Canal after waiting unsuccessfully to transit the drought-stricken Panama Canal on its way from Houston to Ningbo, China.#LPG @ed_fin @DrastikThomas pic.twitter.com/l2KeX9iWp6

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).