🎣 Fentanyl's Freight Playbook

The fentanyl pipeline is the dark mirror of global logistics: lean, fast, and deadly. And while freight fights inefficiency, the cartels are mastering scale.

We're covering Q4 2023 earnings summaries for ArcBest, Marten Transport, and Werner Enterprises: financials and future outlooks.

ArcBest, Marten Transport, and Werner Enterprises recently reported their Q4 earnings for 2023, showing resilience in navigating a tough freight climate.

ArcBest's report highlighted a mix of achievements and setbacks. While their revenue dipped to $1.09 billion, a 12.4% decrease from the previous year, they posted a net income rise to $48.79 million, reflecting a solid profit gain from $37.34 million a year ago.

But the company had a lot to celebrate looking at its full-year 2023 revenue: $4.4 billion, the second-best annual revenue in the company's history.

Their earnings per share (EPS) also increased to $2.47, slightly up from the year-ago quarter's $2.45, beating the Zacks Consensus Estimate by 12.79%.

Despite revenue contractions in asset-light and other segments, their asset-based segment barely shifted, indicating a stable core operation.

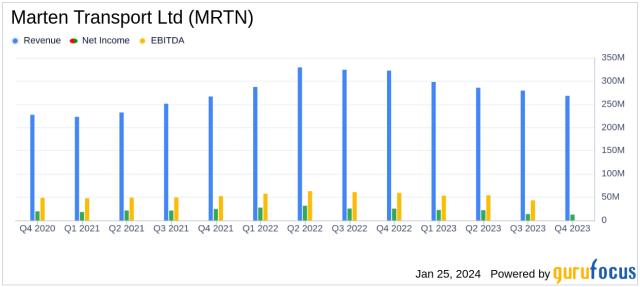

Marten Transport's Q4 2023 earnings report reflects a challenging quarter and year-end financial performance. The company reported a net income of $70.4 million, down from $110.4 million in 2022, with a significant decline in net income and operating revenue.

The annual operating revenue decreased to $1.131 billion from $1.264 billion, and operating income for the year was $90.1 million, a decline from $143.3 million in the previous year.

Executive Chairman Randolph L. Marten commented that the quarter's earnings were heavily pressured by the freight market recession's weak demand and inflationary operating costs. He also mentioned that the company's resilience and strategic initiatives will be key factors in its recovery and future.

Werner Enterprises, Inc. reported its Q4 2023 earnings results on February 6, 2024. The company's revenue for the quarter was $821.95 million (down 5%), beating estimates by $1.08 million, but earnings per share (EPS) of $0.39 missed estimates by $0.05.

The company's CEO, Derek Leathers, commented that the company's results reflect the challenging operating environment, but the company's strategic initiatives and disciplined capital management have allowed it to navigate the market's headwinds.

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).