🎣 2026 Freight Predictions (Print Preview)

A preview from FreightCaviar Print. December copies are still available.

Container rates hit new highs, causing shipper worry. With tender rejections in LA hitting 2-year highs, FreightWaves' Craig Fuller is "bullish" on 2H recovery.

The shipping industry is experiencing significant disruptions as container rates continue to soar, causing anxiety among shippers about their cargo being rolled.

Key Factors Driving Rate Increases:

Judah Levine, head of research at Freightos, stated, "With capacity and equipment scarce and spot rates now several thousand dollars above long-term contract levels, annual agreements are once again becoming unreliable."

This sentiment is echoed by Emily Stausboll, an analyst at Xeneta, who emphasized the critical nature of relationships between carriers, shippers, and freight forwarders during these times.

A recent Freightos survey found that nearly 70% of BCOs and forwarders with long-term ocean contracts have faced containers being rolled, pushed to the spot market, or forced into contract renegotiations.

"In speaking with a high-level executive from one of our carriers Friday, he pointed out that almost every port in the major trades has roll-over pools stretching 2-3 weeks now. While their larger shippers have a fixed weekly allocation and the carriers are more obligated to take these bookings, assuring those containers are actually loaded is not as certain. As the clock ticks down to the day of sailing, the carriers see all the desperate, last-minute, spot cargo hoping to snag a spot on the vessel and can't help themselves." – Stephanie Loomis, Head of Ocean Freight for the Americas, Rhenus Logistics

Craig Fuller's Predictions:

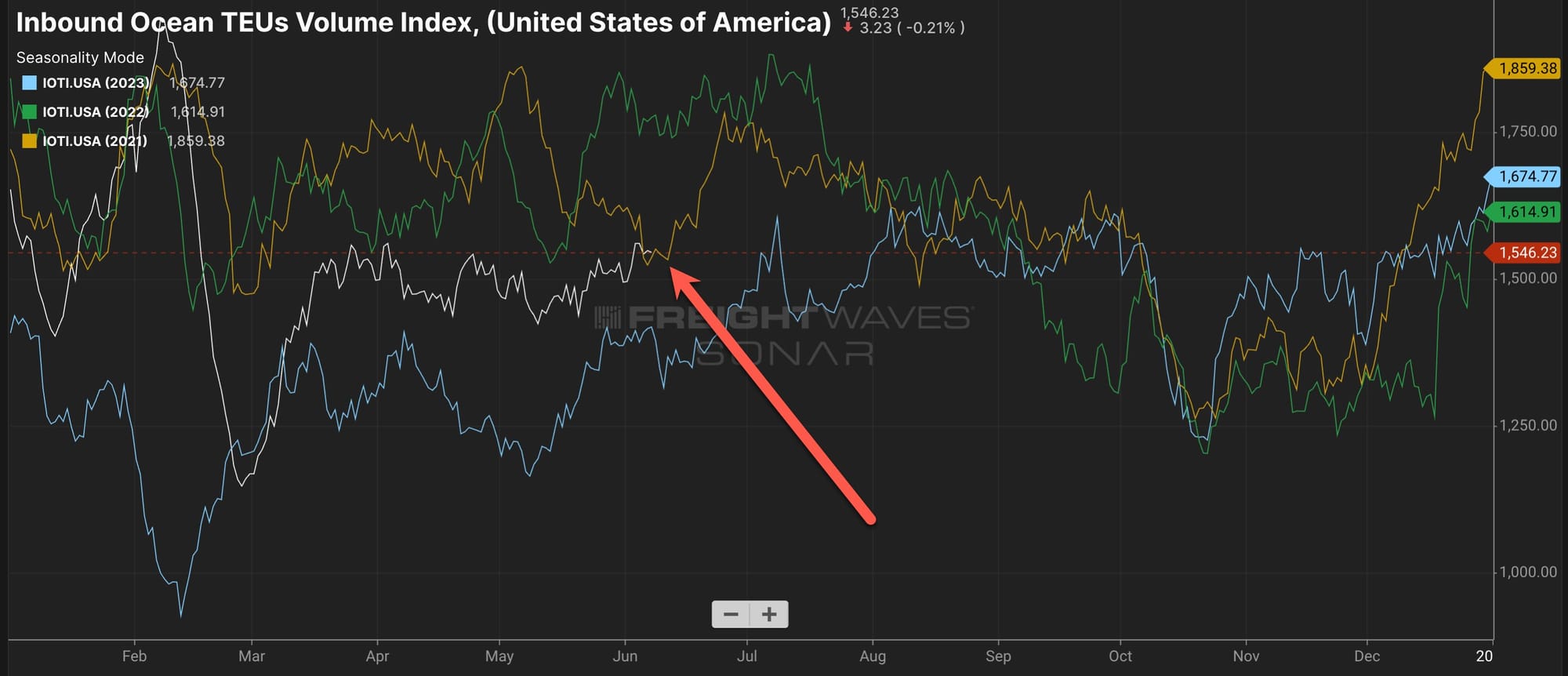

FreightWaves CEO Craig Fuller is optimistic about a recovery in the trucking industry in the second half of 2024. He pointed out that container volumes bound for the US are returning to 2021 levels, driven by retailer confidence in consumer demand for the latter half of the year. Fuller remarked, "Ocean freight always ends up in trucking or intermodal at some point."

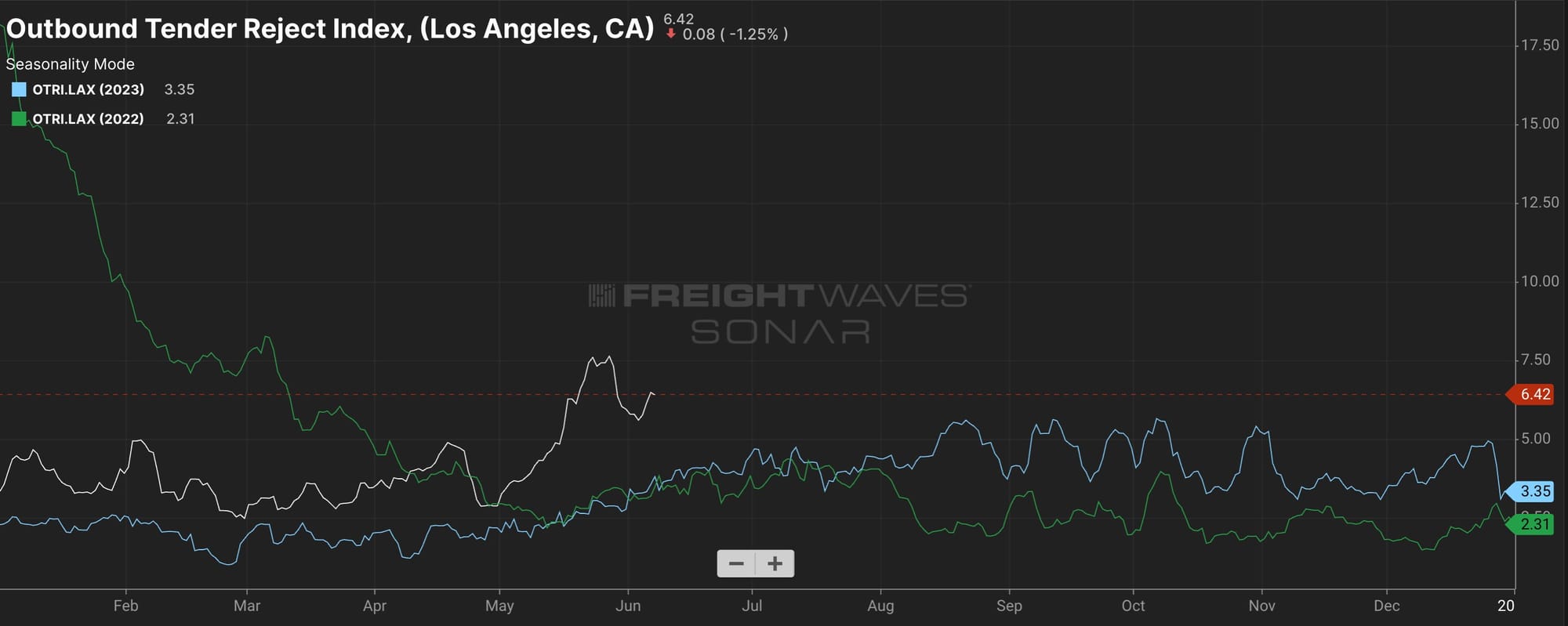

He also noted that tender rejections out of Los Angeles are hitting two-year highs, driven by increased import demand. "What happens in LA eventually happens in the rest of the country," Fuller said, underscoring his bullish outlook.

I would like to see the customs data to confirm, but it seems to be just short term pull forward ahead of potential tariffs and port strikes. I don't see the market demand with stable inventory levels and poor consumer confidence. Maybe I am missing something or data is wrong pic.twitter.com/kcxygv6ctp

— BBQ Spider Pig (@Fbsaltfly) June 8, 2024

Others suspect this may just be an early boost to get ahead of expected tariffs and strikes.

Sources: Splash247 | Craig Fuller/X

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).