DAT And AscendTMS Bring Fully Digital Freight Transactions To The Masses

AscendTMS brokers can access the Convoy Platform integration regardless of whether they are DAT customers.

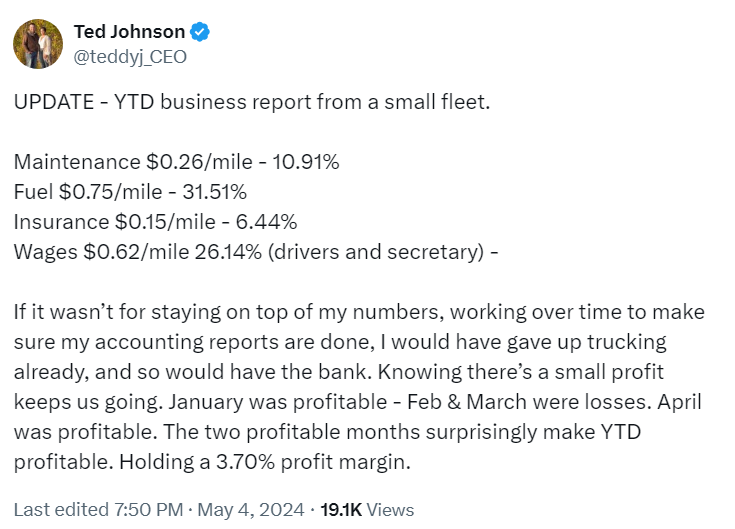

Elite Commodity Express demonstrates the resilience of small fleets. By meticulously tracking expenses and optimizing efficiency, CEO Ted Johnson explains how the stay profitable.

Last week, we reported on the shutdown of a large trucking company and the impact of these closures on the overall freight market.

However, data shows that many smaller fleets are managing to survive this freight recession. Despite fluctuating fuel prices, increasing maintenance costs, and squeezed profit margins, these smaller fleets are hanging on.

A recent post from the CEO of Elite Commodity Express out of Surprise, Nebraska, gives us a glimpse into how small carriers keep the wheels turning.

With January and April profitable, but losses in February and March, the fleet managed a slim 3.7% profit margin.

The company's Lost Fr8 profile indicates a fleet of 10 trucks and 12 reefers, showing its focus on specialized services in refrigerated freight.

According to CEO Ted Johnson, the company has maintained its financial stability through meticulous data tracking and comprehensive accounting practices.

Johnson emphasizes the importance of data-driven decision-making. He uses a specialized software, Profit Gauges, to meticulously track every expense and revenue stream.

Each expense—from fuel costs to maintenance bills—is entered into the software, allowing Johnson to generate accurate profit and loss reports.

This level of detail helps him understand the business's financial health and make informed decisions, which has been vital in navigating the market downturn.

Uber Freight's Senior Economist Mazen Danaf points out that Elite's reefer cost per mile is $2.38, and factoring in non-revenue miles, the cost per revenue mile (CPRM) is $2.80.

This exceeds both national spot and contract rates, making profitability extremely tough for carriers in this market.

The success of Elite Commodity Express is a testament to the hustle and grit of small fleets in a turbulent freight market. Ted Johnson’s razor-sharp focus on his fleet’s numbers shows that even in tough times, you can stay in the game with the right playbook.

Keeping a tight handle on every expense and finding every possible efficiency has kept Elite Commodity Express moving forward, despite a market that’s trying to run smaller players off the road.

For small trucking companies looking to stay afloat, this is a prime example: the right mindset, relentless attention to detail, and knowing your numbers inside out will keep your trucks rolling, even when the industry’s on shaky ground.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).