🎣 Freight vs. Tariffs

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

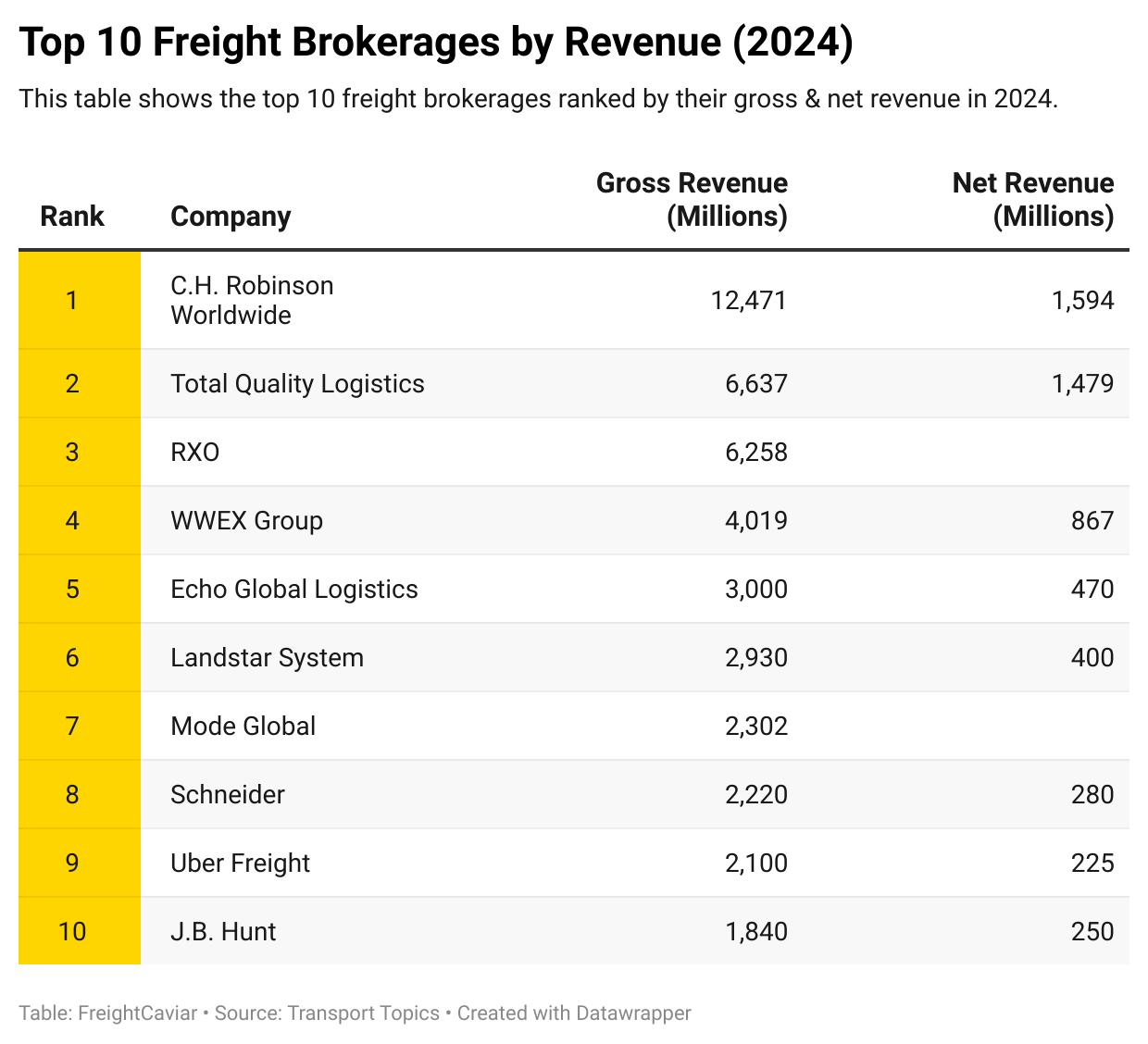

In 2023, the top 10 brokerages earned $53.25 billion in gross revenue. In 2024, that figure dropped to $43.77 billion — an almost 18% decrease.

In today's newsletter, we’re diving into the largest players in our industry for 2024. There have been some big changes over the years, and we're here to break it all down for you.

Looking to ship sustainably? D-B Cartage is driving change with their zero-emission fleet. Check out how they’re changing the industry in our latest article, Electrifying the Future.

Why D-B Cartage Stands Out:

Whatever your freight needs, they have you covered.

Since 2016, Transport Topics has ranked the top 100 freight brokerages by revenue. Today we’re focusing on the top 10.

To view the full 2024 list, click here.

Six of the top ten freight brokerages are publicly traded.

Here’s their year-over-year stock performance:

Fun Fact: Echo Global Logistics went public in 2009 but returned to private ownership in 2021 after being acquired by The Jordan Company.

TQL is unique among the top ten freight brokerages — it’s the only one majority-owned by a single individual.

Founder Ken Oaks still owns 99% of the company, setting TQL apart from other companies that are either publicly traded or backed by private equity.

Did you know? TQL has grown entirely through organic expansion, while most others on the list have acquired competitors along the way.

Want to know how Ken Oaks turned TQL into a freight giant? Read more about his journey in our deep dive here.

WWEX (Worldwide Express) was formed through the merger of three companies in 2021:

This merger created one of the largest freight brokerages in the industry.

In 2021, right before the merger, GlobalTranz ranked as the 9th largest brokerage, while Worldwide Express held the 10th spot.

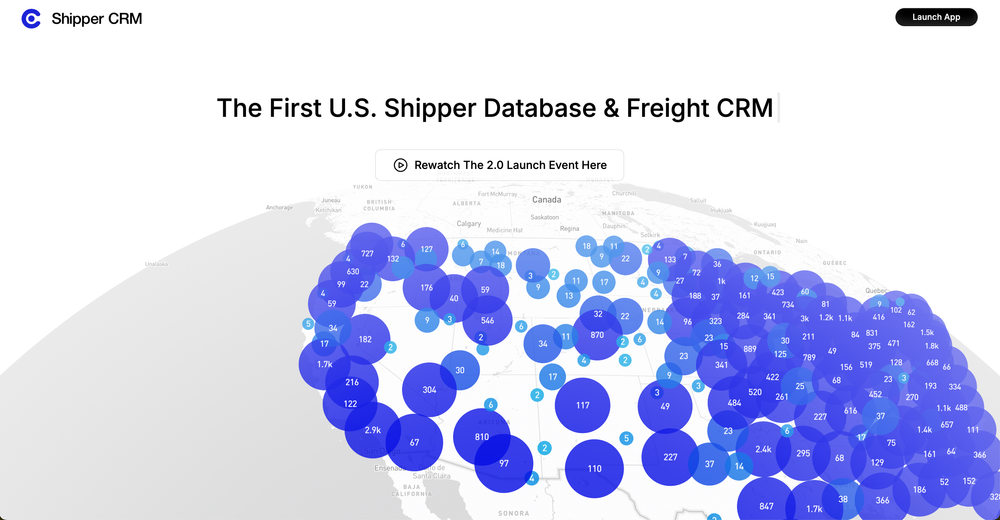

Stop wasting time searching for shippers—ShipperCRM (a FreightCaviar product) is the fastest way to find the shippers you should be working with.

ShipperCRM offers four key features:

Supercharge your sales process with ShipperCRM!

Landstar is one of the largest and most profitable transportation companies in the U.S., but it’s not without its controversies.

We wrote a deep dive on Landstar last month as well. Click here to read it.

Mode Global operates through an agent-based model, relying on independent agents for sales and operations.

This approach was bolstered by its acquisition of SunteckTTS in 2019, creating a company with over $2 billion in revenue.

In 2019, before the merger, SunteckTTS ranked as the 10th largest brokerage, while Mode was the 12th.

The freight brokerage landscape is constantly evolving, with new players rising and familiar names making major moves. Want more insights like these? Stay tuned for future newsletters where we break down the industry’s biggest stories.

Got thoughts or feedback? Let us know by replying to this email!

🎣 THE FREIGHT CAVIAR CORNER

FREIGHT MEME OF THE DAY

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).