🎣 Liberation Day

Plus, a $350K beef fraud sheme, trucker faced 17 deportations prior to deadly crash, Transfix debuts new tech, and more.

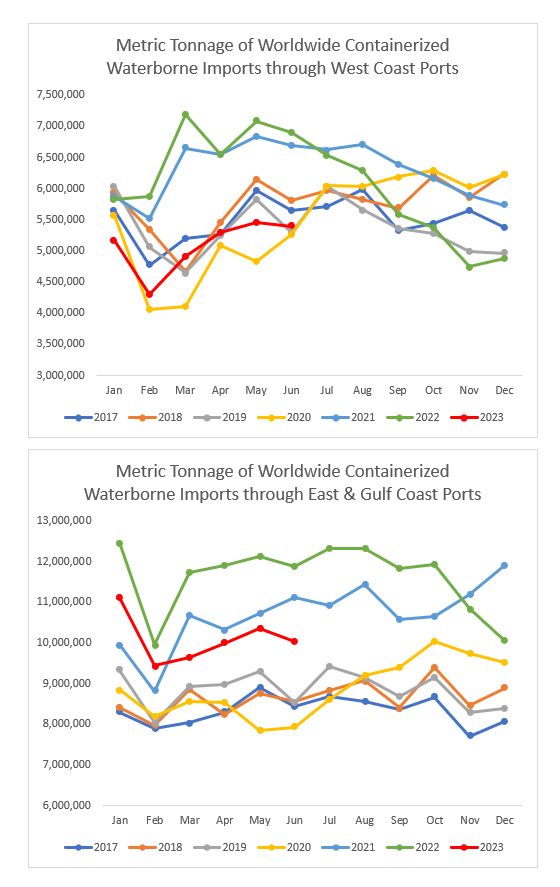

An in-depth look into the shifting dynamics of US ports, emphasizing a movement away from the West Coast in favor of the East and Gulf Coast ports.

Recent data and industry observations suggest a significant shift in containerized imports in the US, marking a movement away from the West Coast ports in favor of the East and Gulf Coast counterparts. Jason Miller's analysis on LinkedIn reveals a notable decrease in imports through the West Coast ports, with metrics highlighting:

This trend, Miller pinpoints, stems from importers investing heavily in transloading facilities and distribution centers near the East and Gulf Coast ports and the shifting import volumes from China towards South Asia.

Lazar Gacevski's response to Miller's insights further underscores this shift. He attributes it to factors like the West Coast's diminished capacity, higher operational costs, and the geographical distance from the main body of consumers in the Midwest and East.

Validating these observations, the Port of New York and New Jersey recently celebrated a peak, processing an impressive 725,479 TEUs in July - its highest since October 2022. A sharp contrast is seen with the Port of Los Angeles, which witnessed a 26% drop in TEUs processed YoY in July.

The strength of trade at the East and Gulf Coast ports continues unabated through the Panama Canal, despite current congestions. The canal remains the favored route for container carriers, even with conservation measures that elongate wait times. Roughly:

Sources: Jason Miller: LinkedIn , Lazar Gacevski: LinkedIn , FreightWaves

Finally! New York/New Jersey was the #1 volume port in July for the first time in forever. Exporters/Importers avoided the West Coast because of this labor issue. Good news is that the East Coast union, the ILA, has a contract up for renewal in 2024 https://t.co/o2S3TbEWWs

— Mooney Owns You (@MooneyOwnsYou) August 31, 2023

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).