🎣 Freight vs. Tariffs

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

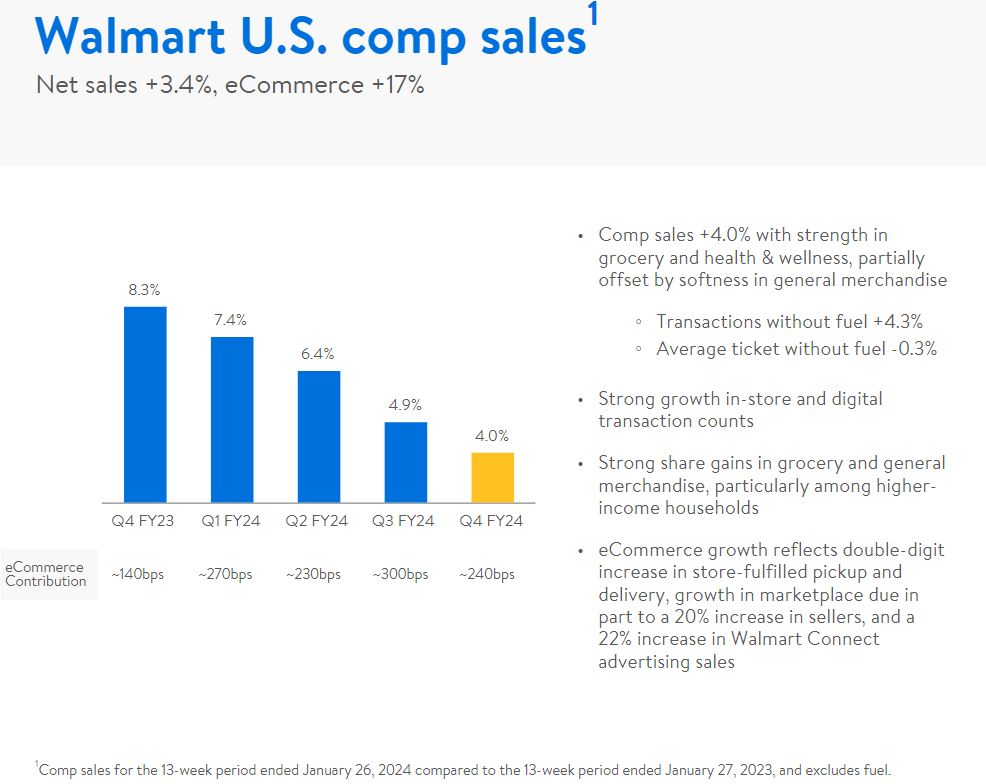

Walmart's Q4 shines with impressive sales and a strategic $2.3 billion Vizio purchase.

To round out the end of 2023, Walmart delivered a performance to remember. The retail giant's fourth quarter results were nothing short of stellar, fueled by price-conscious consumers gravitating towards its cost-effective offerings. Amidst this success, Walmart also announced a bold move to acquire smart-TV maker Vizio for $2.3 billion.

Quarterly Highlights:

Walmart's fourth quarter was a parade of positives:

The cornerstone of Walmart's appeal has been its emphasis on keeping grocery prices low, a strategy that has not only retained but also attracted a broader customer base, including those from higher-income households.

E-Commerce Milestone & Vizio Deal:

2023 was a landmark year for Walmart, with the retailer surpassing $100 billion in global e-commerce sales for the first time. This achievement was bolstered by improvements across its physical and digital storefronts, alongside an expanded array of pickup and delivery options.

The acquisition of Vizio represents a strategic enhancement to Walmart Connect, the retailer's rapidly growing advertising business, which has already been generating $3 billion in annual revenue. With this deal, Walmart not only gains access to valuable viewership data but also strengthens its advertising reach directly into consumers' homes.

Looking Ahead:

For the fiscal year ending January 31, 2025, Walmart anticipates consolidated net sales growth of between 3% and 4%, a forecast that slightly surpasses analysts' expectations. This projection is seen as conservative by some investors but reflects a prudent stance amid fluctuating economic conditions.

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).