🎣 Freight vs. Tariffs

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

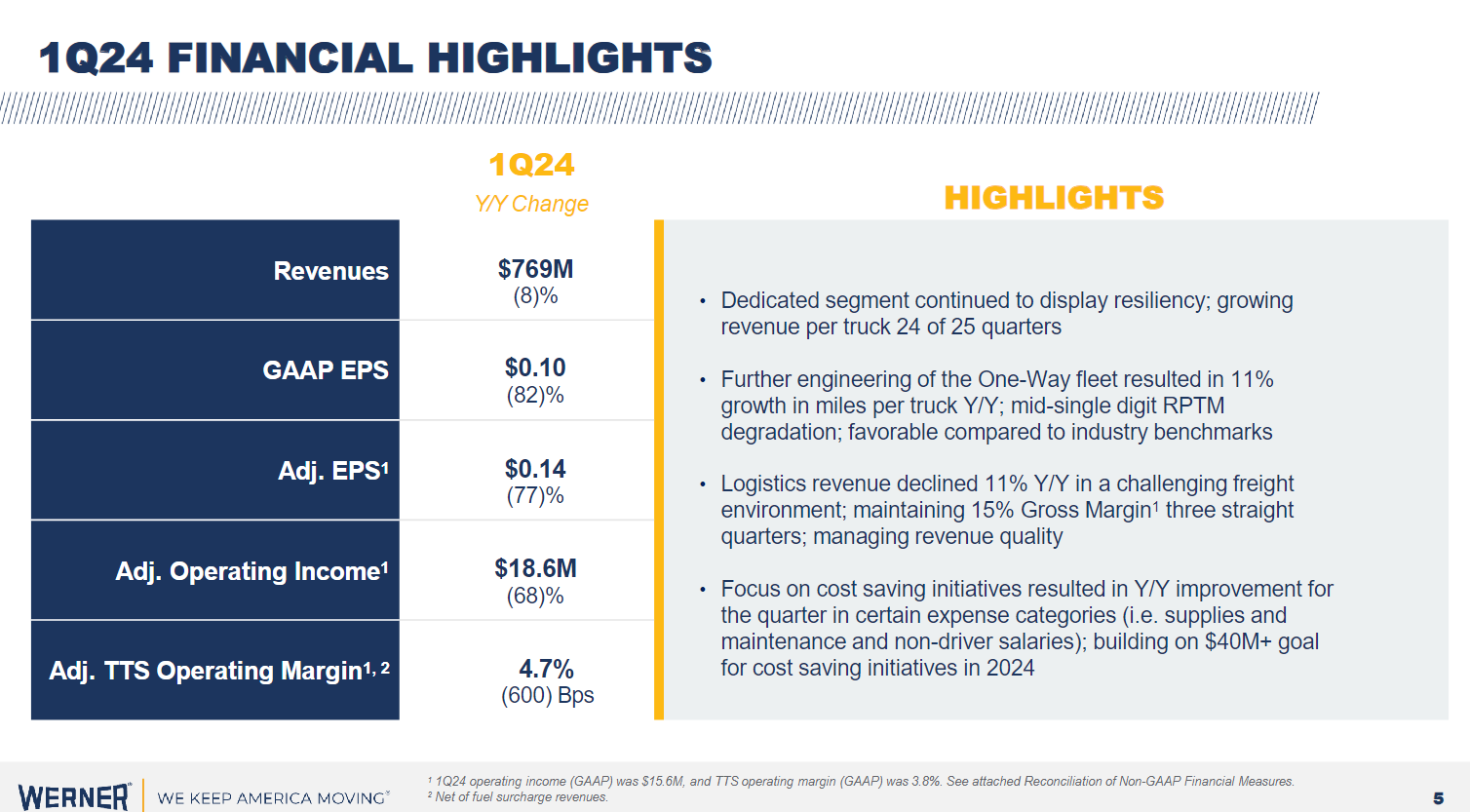

Werner reports hopeful trends despite Q1 challenges, with expectations for seasonal recovery and cost-saving measures.

Werner Enterprises (NASDAQ: WERN) believes the freight recession's end is near. Despite Q1 challenges like inclement weather and insurance costs, it expects seasonal recovery.

However, truckers express skepticism about market recovery, with some saying the reality doesn't match the data.

I see some saying the freight recession is coming to an end but it looks the opposite to me. The last 4 weeks have been the worst for my trucks over the past 5 years. Volumes for refrigerated (contract) freight have been a dumpster fire in my experience.

— JoBangles (@theericredbeard) May 1, 2024

What the “data” says…

Source: FreightWaves | Werner Enterprises

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).