🎣 Trump's Tariffs Weekly Recap

Plus: LAPD busts a $3.9M cargo theft ring, Nuvocargo and UPS expand in North America, U.S. moves to ease rules for self-driving trucks, Funny Freight Friday, and more.

Seasonal Shifts in the Greenscreens.ai cost index show signs of recovery.

As we move into the final quarter of 2024, freight market dynamics show potential signs of bottoming out. Greenscreens' recent data analysis indicates upward cost trends in specific markets, signaling resilience and even growth.

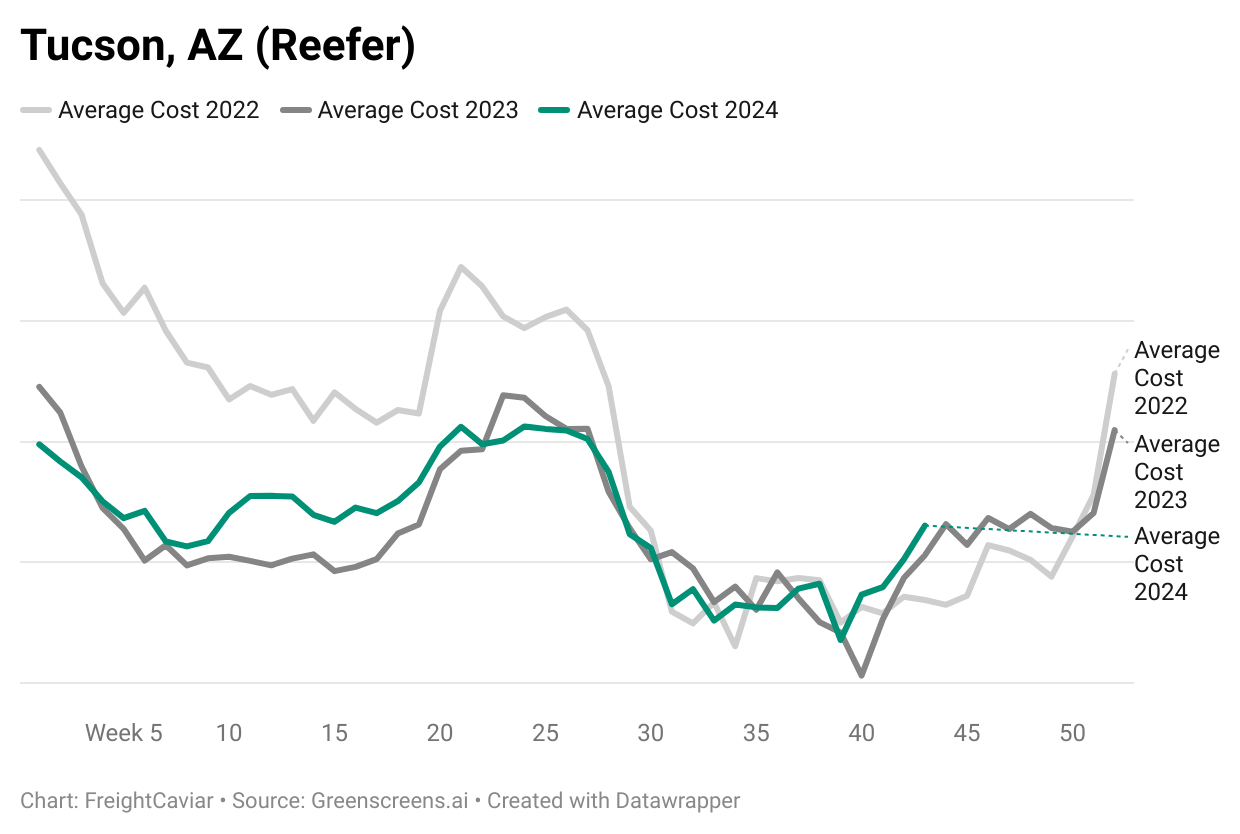

The Tucson, AZ, reefer market is defying typical trends with rates that have jumped above the past two years. Known for its dual produce seasons, Tucson experiences two significant rate peaks each year: melons in the summer and greens in the fall/winter.

Tucson’s rates are a refreshing departure from the industry-wide slump, providing a key revenue opportunity as demand heats up. The “holiday hump” is driving strong pricing power here, making Tucson’s market one to watch.

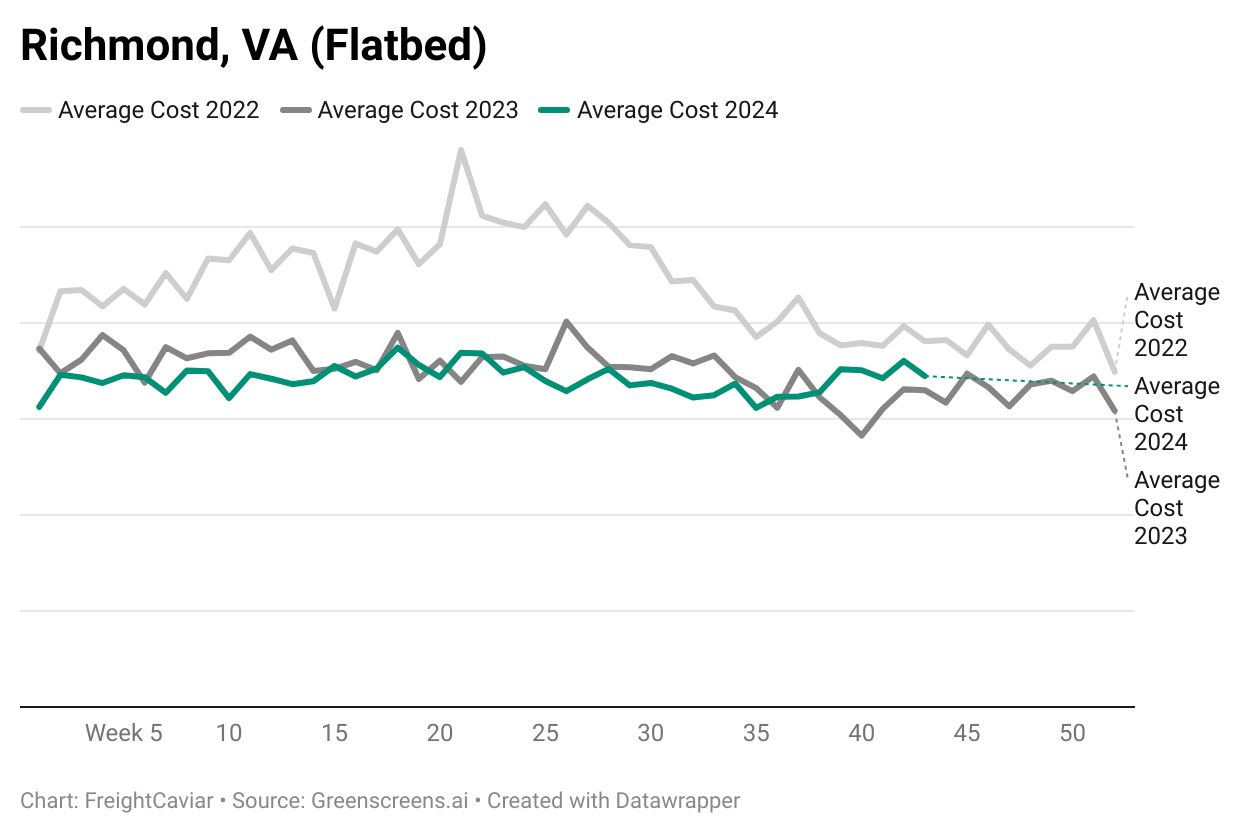

The Richmond, VA flatbed market has shown resilience in the Southeast, especially in the wake of hurricane season. While the rate increases are modest, the Richmond market is steadily maintaining prices above last year’s levels, even if the rise isn’t extreme.

Richmond’s steady climb is significant in a market previously marked by year-over-year rate stagnation. The stability and resilience here indicate strong underlying demand in the Southeast’s flatbed market.

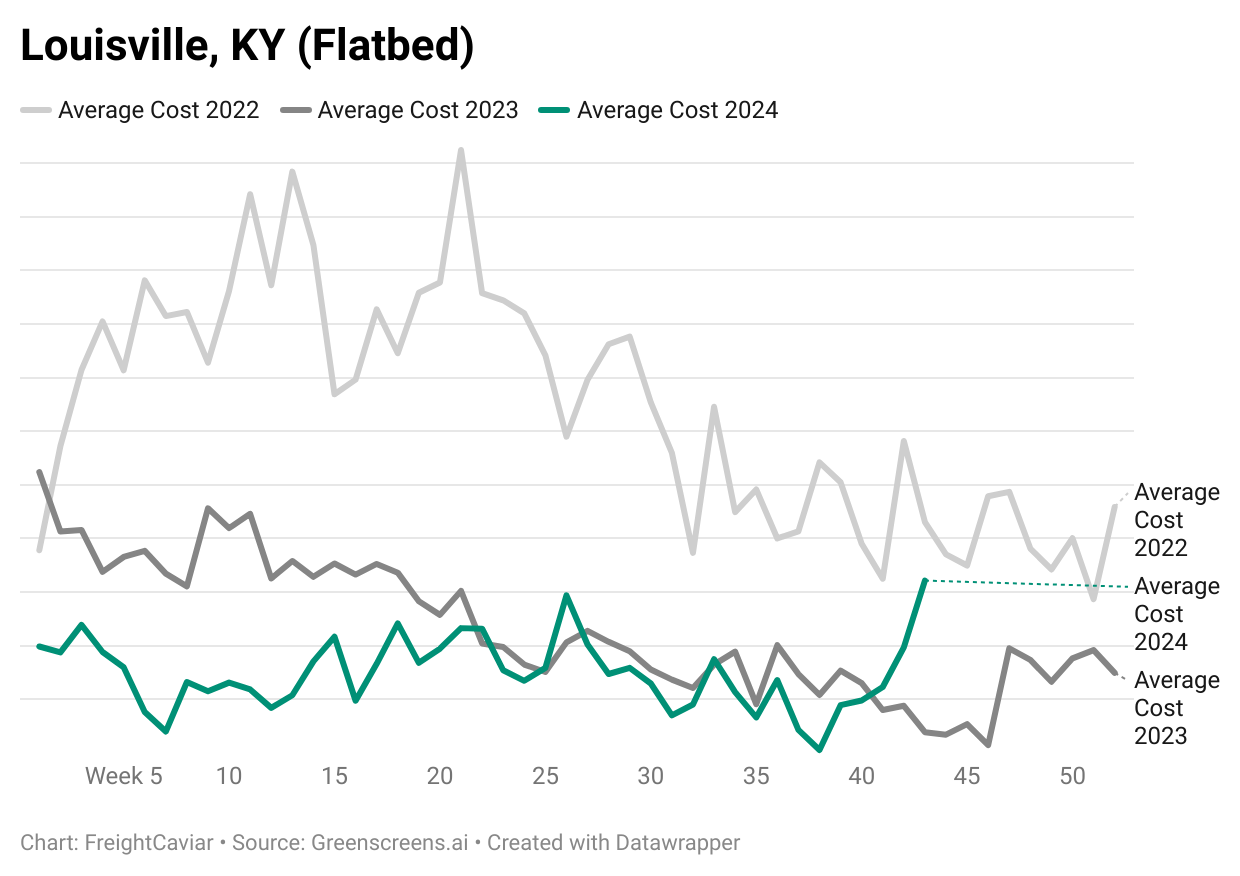

Louisville’s rates, which began 2024 at a lower "price floor," are now nearing levels seen in 2022. Recent weeks show a steady rebound as rates approach the 2022 benchmark, driven by increased demand for cleanup materials post-hurricane.

While 2024 rates haven’t exceeded 2022 levels, this upward movement signals a strong recovery, suggesting the market is moving off its earlier lows, with continued demand likely to sustain this trend.

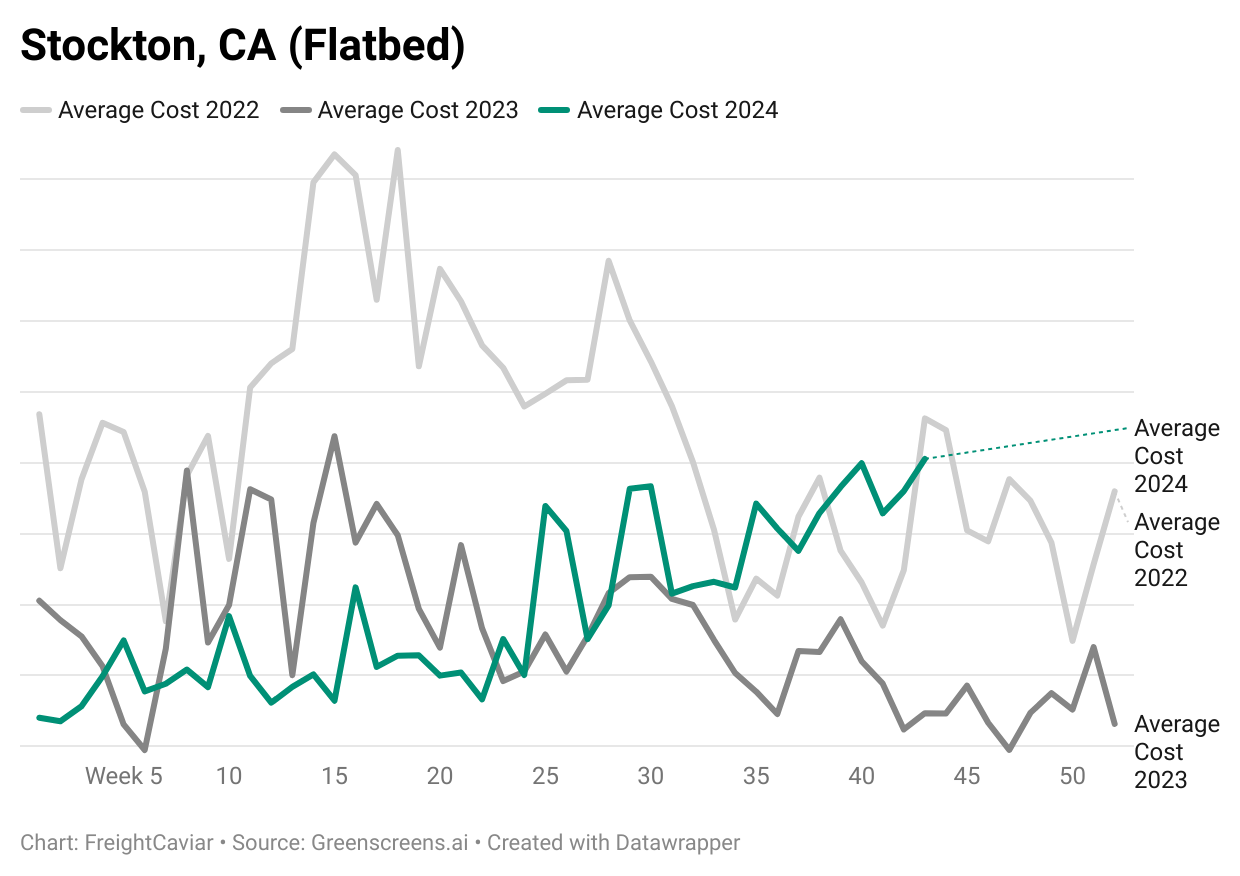

Stockton, California, situated in the fertile Central Valley, is a key hub for various agricultural goods, including high-demand products like tree nuts. While this region often experiences seasonal fluctuations, it’s showing a promising trend of increased freight costs that mirror conditions from 2022.

This movement indicates a potential shift away from the lower 2023 price levels, suggesting a positive rebound in rates for the area.

This progression indicates not just a seasonal spike, but a stronger foundation for rates, potentially providing stability for carriers and brokers operating out of the Stockton market.

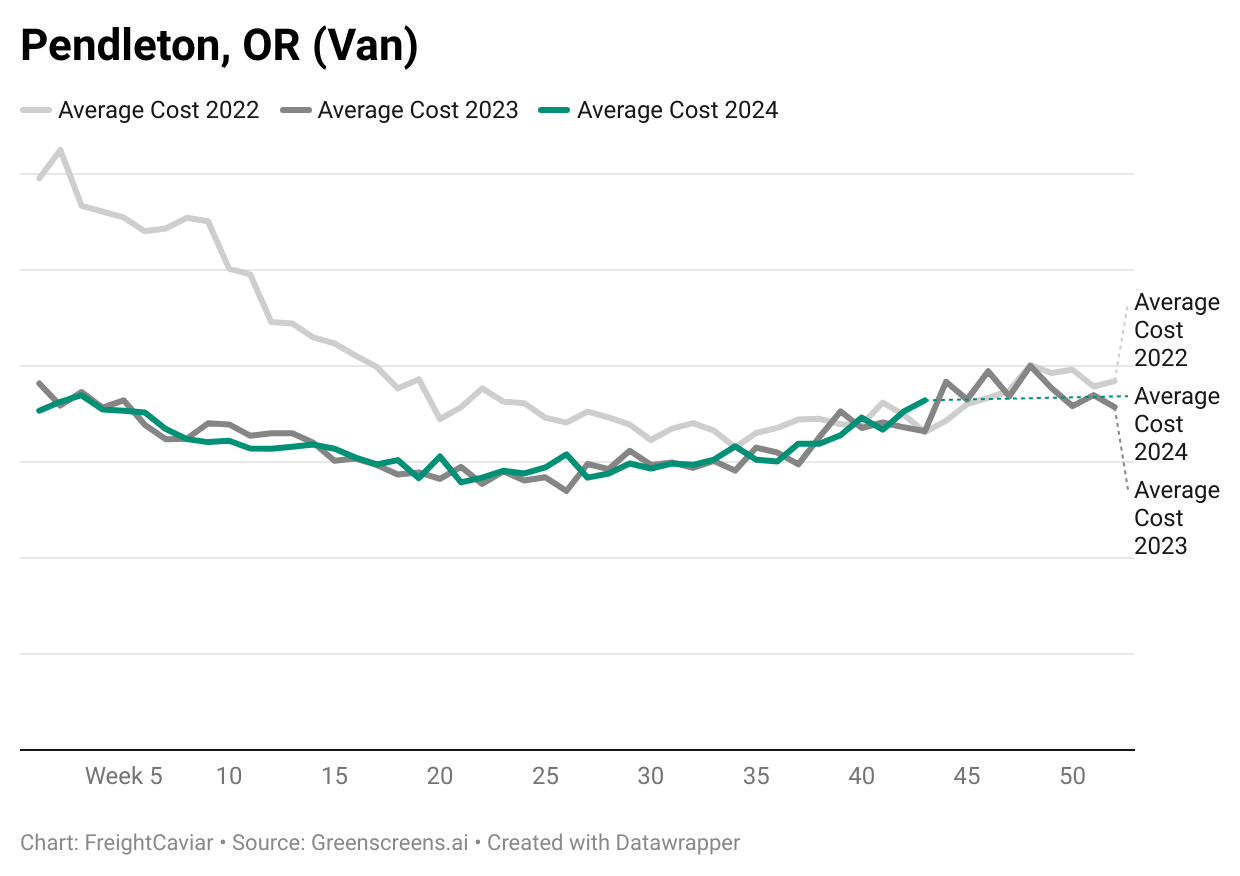

Pendleton, OR, is in a unique seasonal position, with demand cycles peaking from late summer stone fruits to Christmas tree shipments as we enter winter. Recently, rates for dry vans have started rising, signaling a stronger market that’s diverging from 2023’s lower costs.

Pendleton’s recent rate increases provide some optimism, signaling an end to suppressed pricing in the Northwest as demand fuels steady growth.

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).