🎣 Freight vs. Tariffs

Plus, two trucking firms close, harassment claims at TIA conference, a 19.5% week-over-week drop in spot loads, and more.

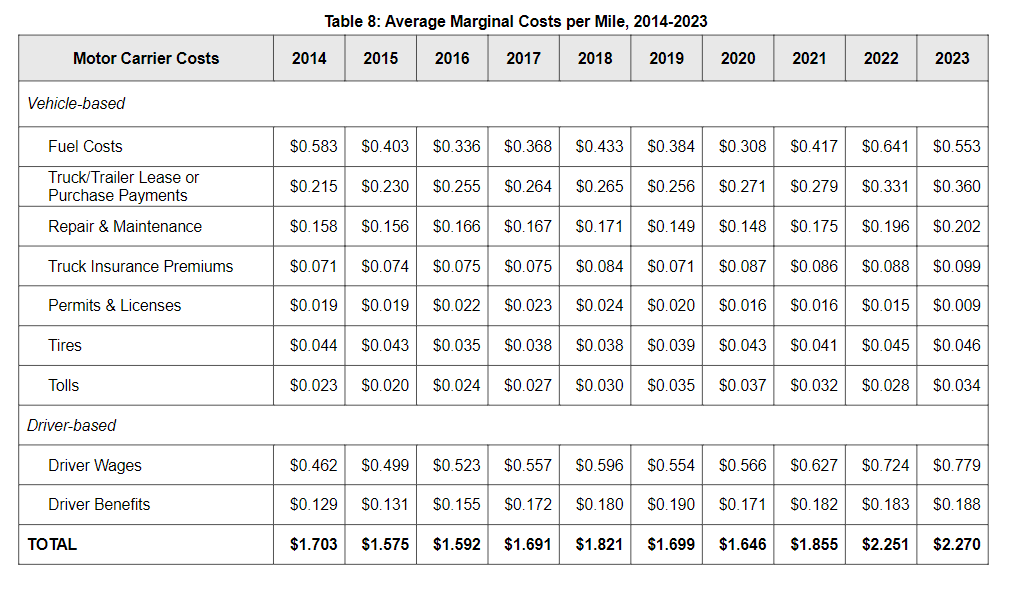

ATRI report reveals a 6.6% increase in trucking operational costs during 2023 freight recession. Here's a breakdown of the numbers.

New research from ATRI shows costs are climbing quickly during this freight recession.

Rising Equipment Costs: Truck and trailer payments jumped up 8.8% to $0.360 per mile. With supply chain issues still lingering, don't expect prices to downshift anytime soon.

Driver Wages Accelerate: Paychecks grew by 7.6% to $0.779 per mile. Good news for drivers, but it's putting the squeeze on carriers.

Maintenance Costs Creep Up: Repair and maintenance expenses inched up 3.1% to $0.202 per mile. Every penny counts in this tight market.

Operational Headaches: Deadhead mileage hit 16.3% for non-tank operations, and driver turnover is on the rise.

Profits in the Slow Lane: With freight rates stuck in neutral, most fleets are seeing razor-thin margins. ATRI President Gregg Troian warns, "The current economic environment makes cost management essential to successful operations."

What's Next? If these trends continue, we might see smaller carriers merging or getting bought out. M&A activity is on the up and up.

Source: ATRI

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).