🎣 Trump's Tariffs Weekly Recap

Plus: LAPD busts a $3.9M cargo theft ring, Nuvocargo and UPS expand in North America, U.S. moves to ease rules for self-driving trucks, Funny Freight Friday, and more.

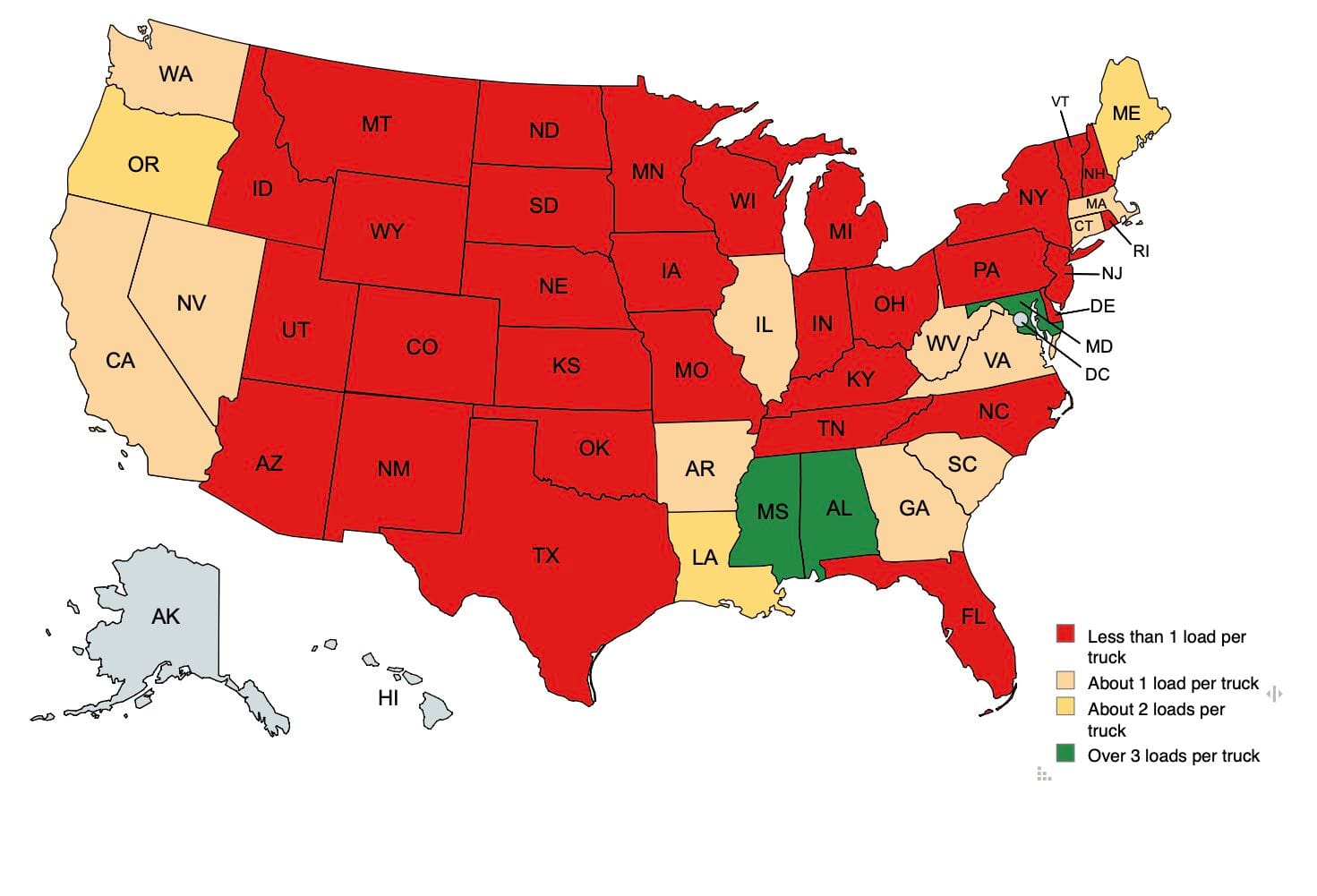

Here's how recent carrier exits and volume trends in the freight market are signaling growth and rate recovery. Experts share their insights.

A post from Ash M., Account Exec at Trucker Tools, highlights a 205 net loss of MCs last week, a small sign of relief for the overstretched freight market.

DAT's Chief of Analytics, Ken Adamo, also shared his insights on capacity exits, commenting, "We've net lost nearly 36k interstate motor carrier authorities since October of 2022, and that number is still growing."

Alongside these exits, volume trends are stabilizing, matching 2023 levels and hinting at potential growth. However, tender rejections remain low, and diesel prices, though high, show a gradual decline. Equipment-specific insights reveal nuanced market behaviors:

Sources: Ken Adamo/LinkedIn | Ash M./LinkedIn

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).