🎣 DOT Drops the Hammer

Plus: Supreme Court tariff ruling is pending, private equity buys 90-year-old Dart, U.S. Bank, DAT launch rates report

Heartland Express, Covenant Logistics, and Knight-Swift Q2 earnings show mixed results, debt reduction, and market stabilization signs.

Trucking titans Heartland Express, Covenant Logistics, and Knight-Swift recently released their Q2 earnings, showcasing a mix of challenges and cautious optimism. Heartland Express is grappling with a staggering 99.9% operating ratio, while Covenant Logistics managed to beat earnings estimates despite a weak freight market. Knight-Swift, meanwhile, sees potential market stabilization following strategic fleet optimizations and expansions.

Here are some key takeaways from their latest financial reports and what industry experts are saying about the road ahead.

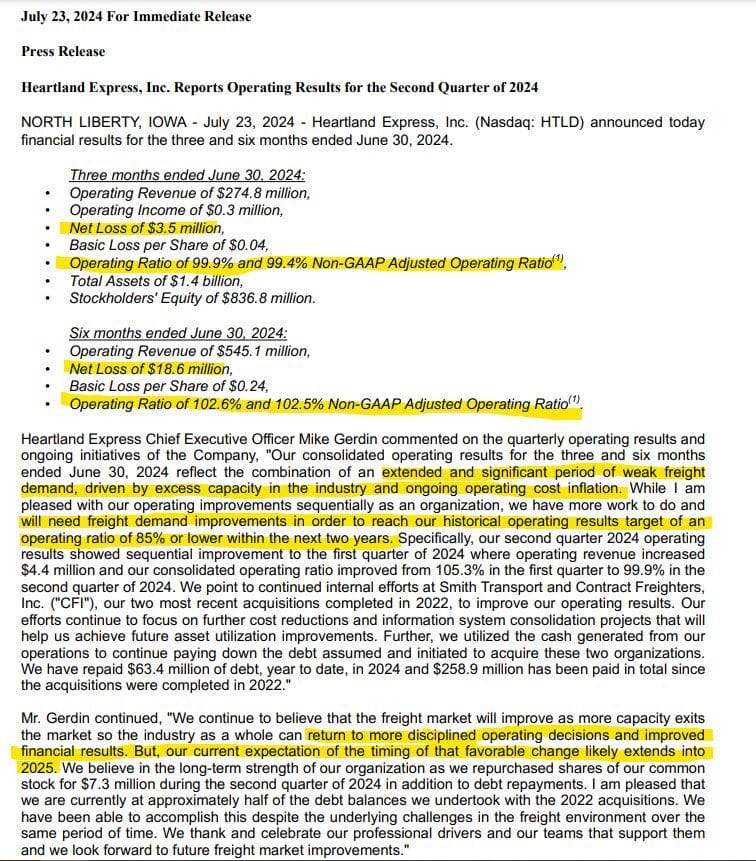

Operating Ratio Woes Heartland Express (HTLD) reported a disappointing Q2 operating ratio (OR) of 99.9%, and year-to-date 2024 is even worse at 102.6%. This starkly contrasts their historical OR target of 85%, signaling major challenges ahead.

Key Stats:

"Heartland spent all our money on two struggling carriers [Smith Transport and Contract Freighters Inc] that looked like a good deal but are actually a hot mess," sums up industry analyst Thomas Wasson.

Revenue & Earnings Beat: Covenant Logistics (CVLG) reported Q2 revenue of $287.5 million, a 4.7% increase YoY, and adjusted EPS of $1.04, beating the consensus estimate.

| Covenant Logistics Group | Q2/24 | Q2/23 | Y/Y % Change |

|---|---|---|---|

| Total revenue | $287M | $274M | 4.7% |

| Truckload combined: | |||

| Revenue | $201M | $185M | 8.7% |

| Freight revenue (ex fuel) | $171M | $155M | 10.3% |

| Revenue per total mile | $2.38 | $2.32 | 2.6% |

| Revenue/tractor/week | $5,726 | $5,678 | 1% |

| Adjusted OR % | 92.5% | 91.6% | 1% |

| Managed freight: | |||

| Revenue | $60.3M | $63.2M | (4.5%) |

| Adjusted operating income | $3.594M | $2.070M | 74% |

| Adjusted OR % | 94.5% | 96.9% | (2.5%) |

| Expedited freight: | |||

| Revenue (ex fuel) | $88.9M | $85.9M | 3.4% |

| Adjusted operating income | $5.302M | $7.953M | (33%) |

| Adjusted OR % | 95.6% | 94.4% | 1.3% |

| Dedicated freight: | |||

| Revenue (ex fuel) | $93.4M | $81.1M | 15% |

| Adjusted operating income | $7.486M | $5.094M | 46% |

| Adjusted OR % | 94.2% | 96% | (1.8%) |

| Adjusted earnings per share | $1.04 | $1.07 | (2.8%) |

Key Highlights:

"Covenant showed consistently strong financial performance over the duration of a very weak general freight market," David Parker, Covenant's CEO, emphasized.

Mixed Results: Knight-Swift (KNX) reported Q2 adjusted EPS of 24 cents, below expectations. However, truckload revenue soared 33% YoY due to the U.S. Xpress acquisition.

| Knight-Swift Transportation | Q2/24 | Q2/23 | Y/Y Gross Change | Y/Y % Change |

|---|---|---|---|---|

| TL: | ||||

| Revenue (ex fuel) | $1,102.8M | $829.4M | $273.4M | 33.0% |

| Average Tractors | 22,828 | 17,851 | 4,977 | 27.9% |

| Miles/Tractor | 20,518 | 18,904 | 1,614 | 8.5% |

| Deadhead % | 14.0% | 15.2% | -120 bps | -7.9% |

| Loaded Miles/Tractor | 17,645 | 16,031 | 1,615 | 10.1% |

| Loaded Miles | 402,811,017 | 286,162,098 | 116,648,920 | 40.8% |

| Revenue per Loaded Mile (ex fuel) | $2.74 | $2.90 | -$0.16 | -5.5% |

| Revenue/Tractor (ex fuel) | $48,309 | $46,461 | $1,848 | 4.0% |

| Average Length of Haul | 385 | 385 | 0 | 0.0% |

| Adjusted OR % | 97.2% | 91.8% | 540 bps | 5.9% |

Strategic Moves:

"We don’t want to be too quick to call it but I think we’re cautiously optimistic that certainly the trough is behind us and we’re on our way to building back," CEO Adam Miller stated, “Again, we don’t want to sit here and call the inflection. Again, we saw positive signs (…), we can’t call it a trend yet. But we’ve seen this market move rapidly."

What's Next?

Despite the mixed financial results, these logistics giants are adapting to market conditions with strategic debt reduction, fleet optimization, and expansion efforts. The freight market shows signs of stabilizing, offering a glimmer of hope for the industry.

Sources: Thomas Wasson (Heartland) | FreightWaves (Covenant) | FreightWaves (Knight-Swift) | The Load Star

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).