🎣 How Guadalajara Became a Hidden Hub for U.S. Logistics

A behind-the-scenes look at Rapido Solutions, the rise of Guadalajara’s freight scene, and why nearshoring in Mexico is all about building real relationships.

PepsiCo invests $175 million in Instacart amid the e-grocery boom. As Instacart files for an IPO, the future of grocery retail might be on the brink of change.

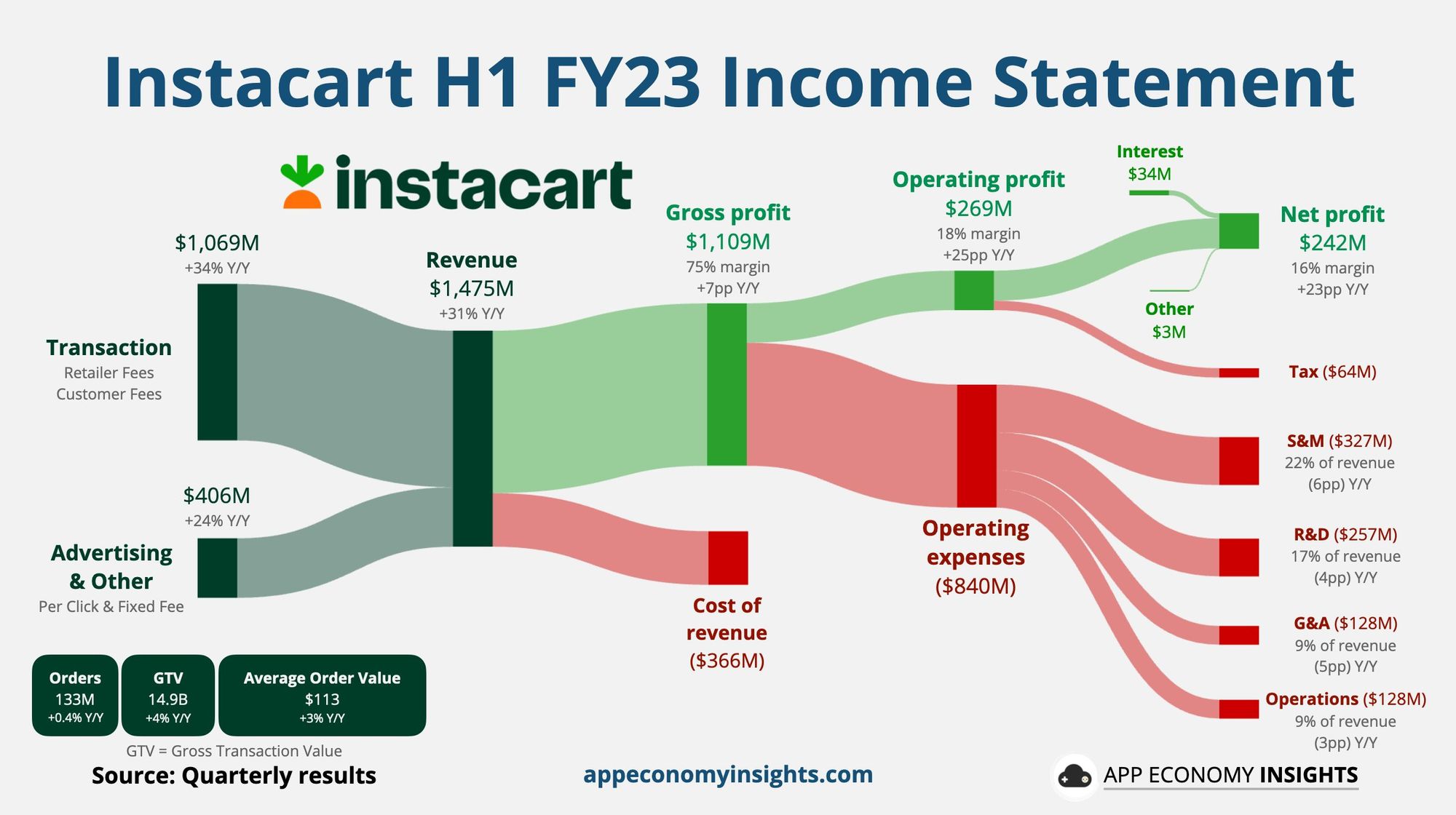

Amid the rising tide of e-grocery, PepsiCo is marking its digital footprint by investing $175 million in grocery technology leader, Instacart. This move, revealed in Instacart's recent Form S-1 filed for an anticipated IPO, underscores a broader trend: food companies are keen on fortifying their digital presence.

Key insights include:

Instacart itself is on the cusp of significant change, filing for an IPO with the SEC, aiming to feature on the Nasdaq Global Select Market under the symbol “CART”. In 2022, a staggering 31% of Instacart's revenue, amounting to $740 million, came from advertising, as per a tweet by Austin Rief. Their association with over 1,400 retail banners, which forms over 85% of the U.S. grocery sector, only amplifies their influence. CEO Fidji Simo perceives a colossal digital metamorphosis in the grocery sector, with online grocery sales potentially doubling over time.

Yet, with change comes critique. Supply chain expert Brittain Ladd likens PepsiCo and Instacart's burgeoning relationship to a strategic diversion, hinting at a potential industry "Pearl Harbor Moment." Ladd speculates that this alliance may empower CPG companies like PepsiCo to sidestep grocery retailers, challenging the traditional retail power dynamics.

Source: PYMNTS

Lots to chew on in Instacart S-1, but was curious what people make of this. Their Snowflake bill was $13M, $28M, $51M in 2020/21/22. 2023 bill will be $15M. Is that just "optimization"? Did they migrate? Is that indicative of the magnitude of optimizations? What's the read here? pic.twitter.com/wOmJJigfxJ

— modest proposal (@modestproposal1) August 25, 2023

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).