🎣 Defense or Offense

Data shows reefer demand started 2026 at its strongest level since ...

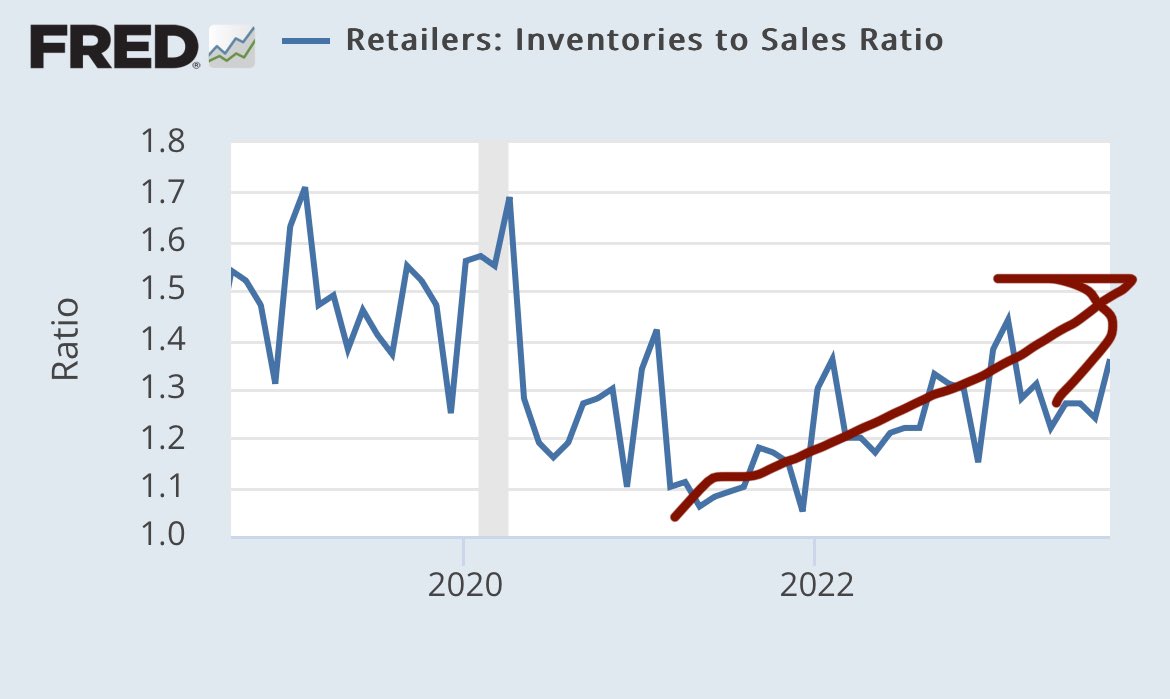

Exploring the shift in inventory-to-sales ratios and its impact on the logistics sector's future planning.

In the logistics landscape, a rising inventory-to-sales ratio signals a shift. As depicted by FRED (Federal Reserve Economic Data), inventory levels have been climbing since 2020, but not in isolation—sales pace is key.

Logistics experts on Twitter, like 10xLogisticsExperts, suggest that the anticipated inventory restocking may hit a pause due to slowing sales. This aligns with the graph's trend, challenging the freight world to reassess its expectations.

Fluctuation and Gradual Increase (2021-2022): Following the initial drop in 2020, the ratio fluctuates but then begins a consistent increase. This upward trend suggests that inventory levels are growing at a faster rate than sales. There are multiple reasons for this:

What this means:

Implications for Trucking & Logistics

Responses speculate about an upsurge in reverse logistics, as companies optimize stock amidst these changes. The industry might need to pivot, focusing less on freight volume and more on inventory management and reverse logistics services.

Overall, this could mean a shift in services from long-haul transportation to more localized distribution and warehousing, and eventually, an increase in transportation needs if retailers adjust their inventory levels, which 10xLogisticsExperts suggests may not be until 2025.

I think the freight world is looking at the wrong thing. Everyone can’t wait for the inventory restock to occur. But, inventory is not stand alone, it is relative to sales. And, as sales slow, this graph shows the #inventory is already growing and likely will have to STOP soon,… pic.twitter.com/5UsLf6wjR3

— 10xLogisticsExperts (@Logisticsexpert) November 18, 2023

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).