🎣 Trump's Tariffs Weekly Recap

Plus: LAPD busts a $3.9M cargo theft ring, Nuvocargo and UPS expand in North America, U.S. moves to ease rules for self-driving trucks, Funny Freight Friday, and more.

C.H. Robinson's operating income is down 60%.

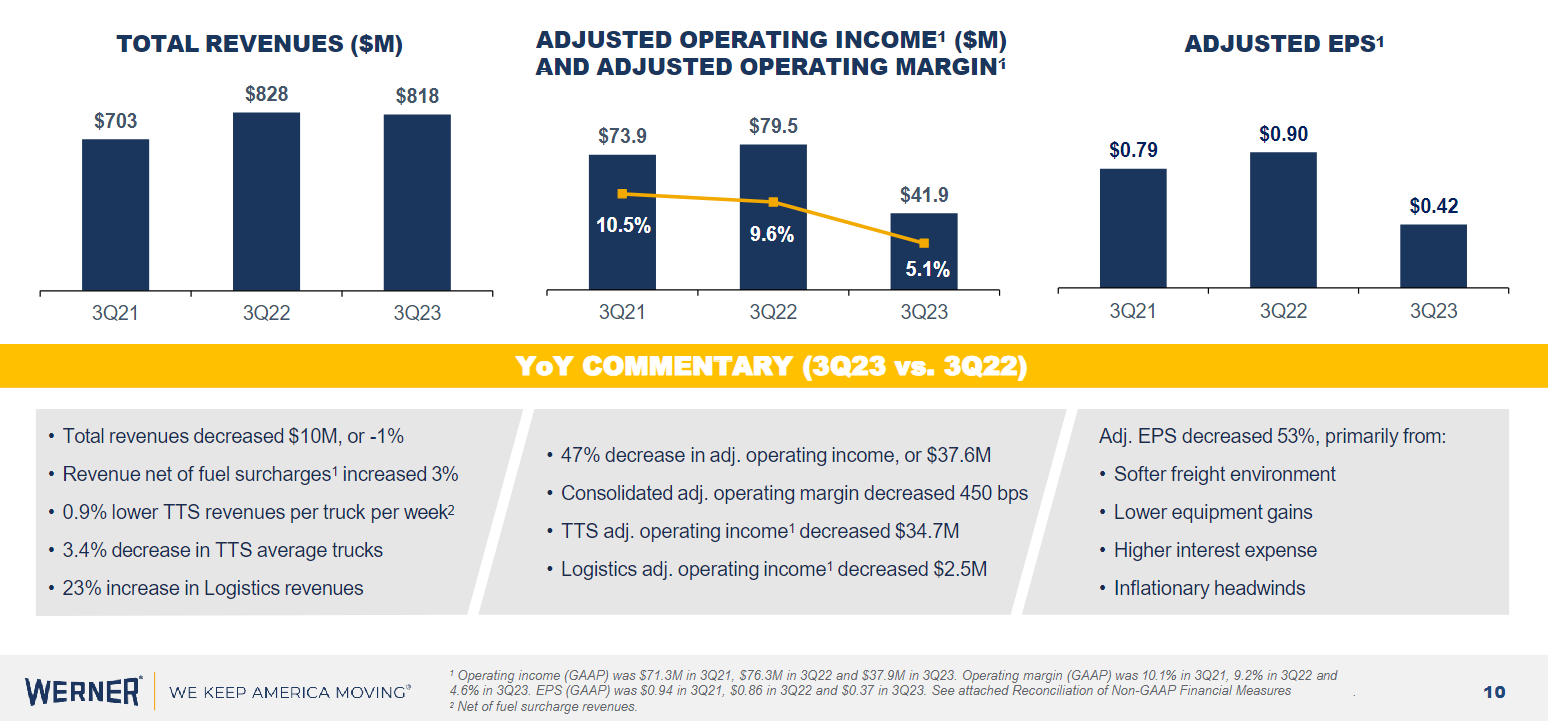

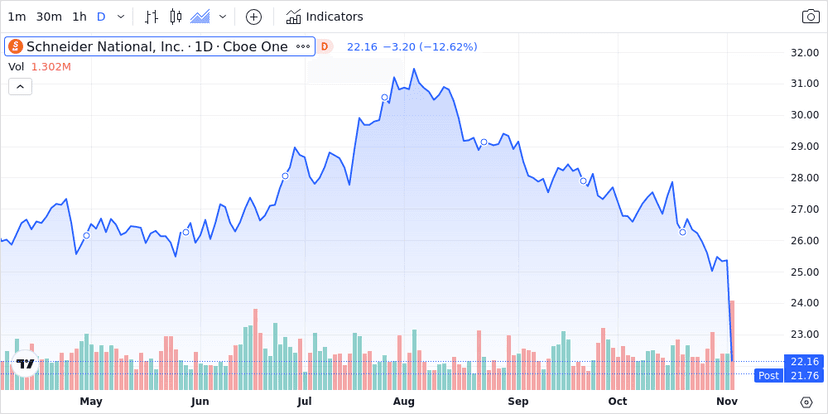

We're shedding light on the Q3 2023 earnings reports from major freight and logistics players: C.H. Robinson, Werner Enterprises, and Schneider National. Each reveals unique challenges and strategies, with some navigating better than others amidst a turbulent market landscape. Cost-cutting, acquisitions, and changing investor sentiment form the backdrop, while smaller entities like Trimble and Nikola provide contrasting narratives.

It's a brutal freight market out there.

— The Conveyor (@ConveyorDaily) November 2, 2023

CH Robinson ($CHRW) gross profits (Jan - Sep):

2019: $2 billion

2020: $1.7 billion

2021: $2.3 billion

2022: $2.8 billion

2023: $1.9 billion pic.twitter.com/yddWouzJQ1

Trimble (TRMB): Q3 transportation revenue rose to $196.6 million, a 35% y/y increase, with earnings of 68 cents per share, beating Wall Street's expectations.

Nikola (NKLA): Net loss of $425.8 million– an increase of 80.3% YoY– after recalling all 209 battery-powered trucks, shipping only three trucks compared to 63 the previous year.

Nikola earnings are rough: “Net loss for the quarter ended Sept. 30 stood at $425.8 million, compared with $236.2 million a year earlier.”https://t.co/EdNEzCil0u

— Dooner 🏴☠️ (@TimothyDooner) November 2, 2023

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).