🎣 Target, Walmart, & Costco

Plus: A 91-year-old trucker still hauls 600+ miles daily, an update on G-Face—“King of Double Brokers,” Trump delays tariffs, and more.

Examine the decline in U.S. consumer spending and confidence with insights from Fitch, BEA, BofA, and The Conference Board data, highlighting a potential upcoming recession.

U.S. consumer spending is facing a substantial slowdown as multiple factors converge.

The Bureau of Economic Analysis (BEA) released data illustrating a decline in U.S. consumer credit card spending on retail and food service (excluding gas stations). The percent difference in spending from the typical level (accounting for day of week, month, and annual trends) fell from 10.1% in August to 4% in September, highlighting a notable reduction.

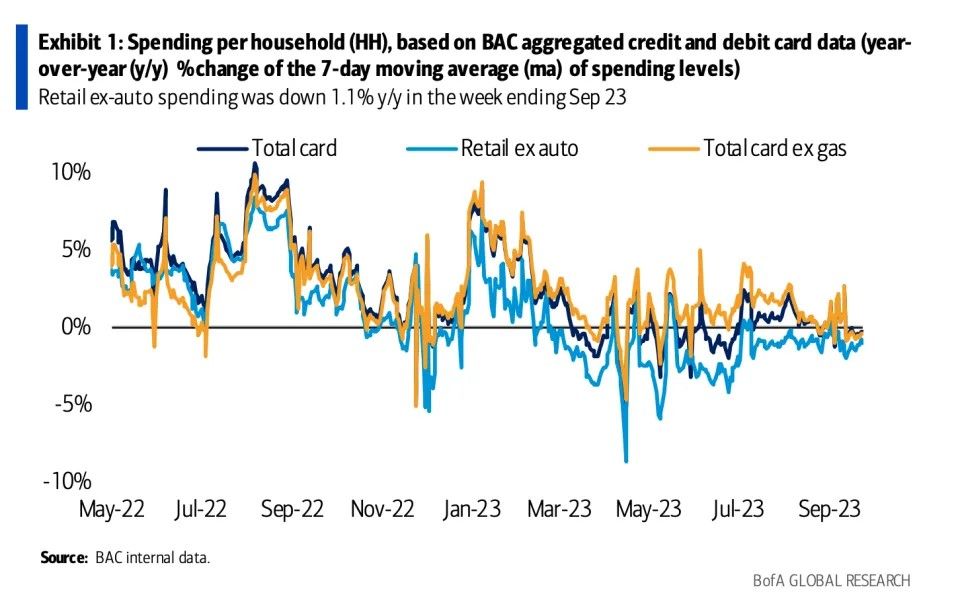

This trend echoes BofA's recent data, revealing a 0.3% decrease in credit card spending in the week ending Sept. 23 compared to last year, and a continuous downward trend excluding auto and gas purchases.

The Conference Board’s consumer confidence index further highlights this, plunging to 103 in September from 108.7 in August, with future expectations at a worrisome 73.7. Readings below 80 historically precede a recession within a year. Retail giants like Target and Home Depot already report declining sales, accentuating the alarm.

Despite the current labor market strength, economists anticipate a more considerable consumption and overall economic downturn for the rest of the year.

Sources: BEA | Yahoo Finance | Fitch Ratings

Join over 12K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).