🎣 J.B. Hunt Up 22%

The Ultimate Freight Meme Competition is starting on LinkedIn live! Get the join link in today's newsletter.

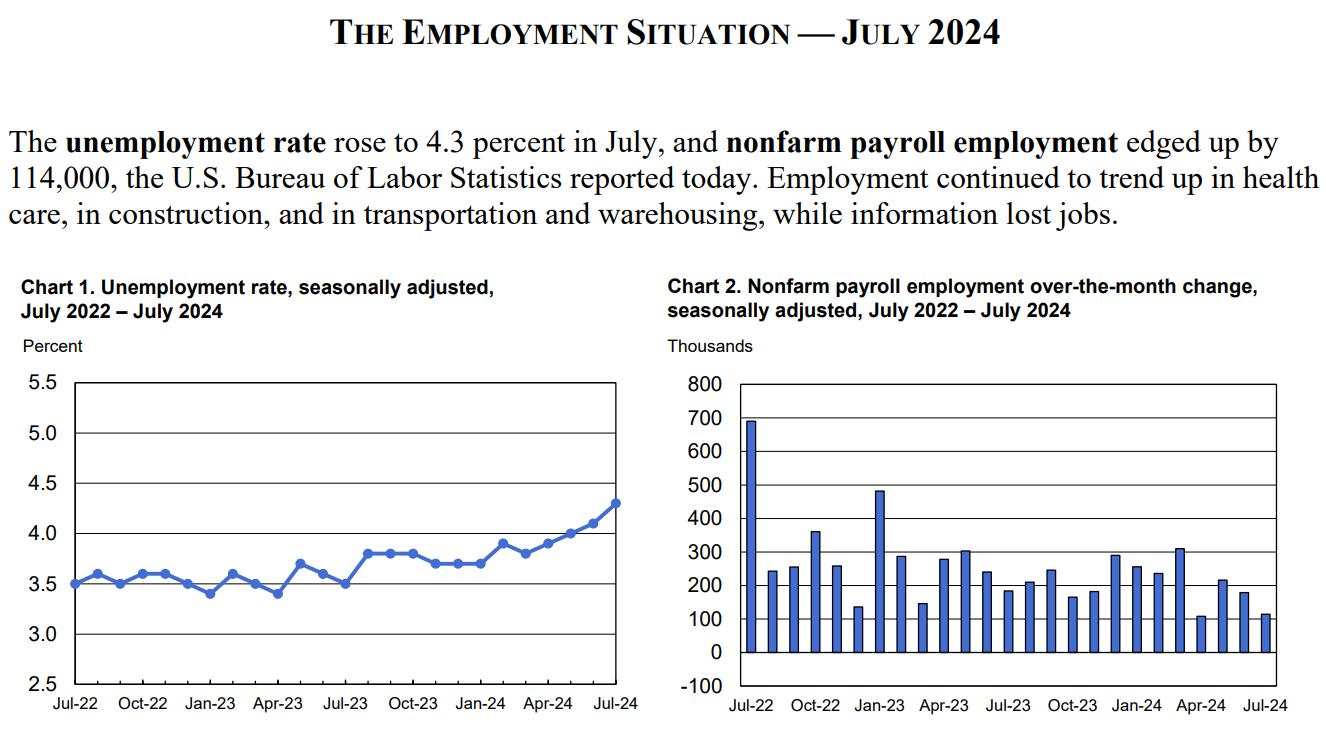

Fed Chair Jerome Powell hints at imminent interest rate cuts to support the labor market. Markets react positively as September meeting looms.

Federal Reserve Chair Jerome Powell hints at imminent interest rate cuts. Speaking at Jackson Hole, he emphasizes the need to support the labor market.

Unemployment hit a 3-year high, prompting Fed action. Powell states, "We do not seek or welcome further cooling in labor market conditions."

Investors are divided on the Fed's next moves. Powell's speech leaves door open for larger cuts if needed.

Powell aims for a "soft landing"

"With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2% inflation while maintaining a strong labor market."

Marc Sumerlin, Evenflow Macro mentioned, "Chair Powell's Jackson Hole speech was as clear a pivot toward supporting the labor market as could be imagined."

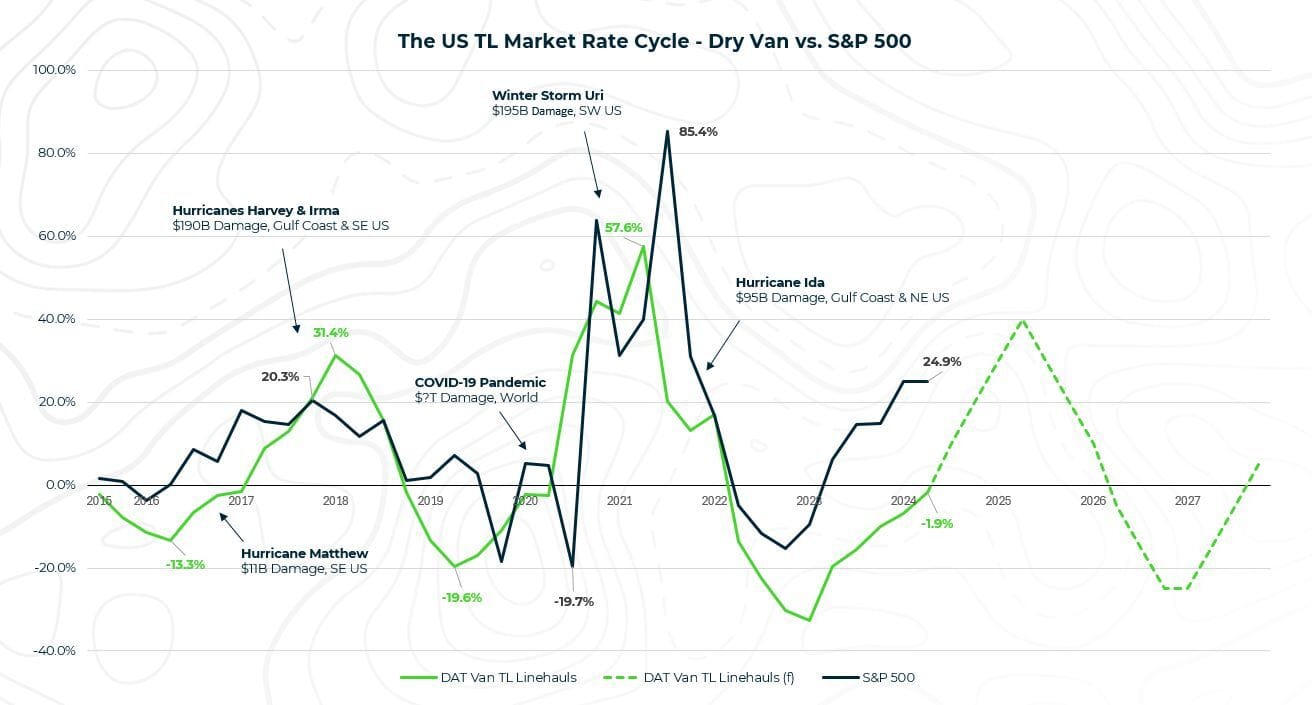

The Fed's upcoming decisions will be crucial for the US economy. And what about freight? These potential cuts could help the industry with its problems and its current rebounding after tough times. Mike Beckwith believes its the freight market resurgence is a clear sign that the US is improving:

"The trucking industry is a leading indicator for the direction and health of the American economy. Change my mind."

The labor market remains a focal point for our future truckload demand forecast. Unemployment has risen to 4.3% in August from 3.5% in July 2023, a move with a magnitude that in the past has been predictive of future recessions. Additionally, job growth continues to slow. These are both signs of cracks in the consumer outlook.

However, Bank of America reports that wage increases across all income brackets have mitigated the impact of these factors and supported steady spending. Consumers are finding ways to buy the same amount of goods, even if that means purchasing discounted or lower-cost items. These trends might indicate a deviation from historical indicators and point toward forthcoming economic challenges. That being said, if wages and jobs continue to slow or decline, it could negatively impact freight demand.

Despite the upward pressure on wages, the labor market's overall dynamics are showing signs of strain. While wage growth has been a stabilizing factor, the sustainability of this trend is questionable given the broader economic headwinds. If the labor market continues to soften, with rising unemployment and slowing job growth, it could lead to a more pronounced downturn in consumer spending. This, in turn, would likely result in decreased demand for truckload freight as companies adjust to a more cautious and cost-conscious consumer base.

Time will tell how things will play out.

Source: WSJ | Arrive Logistics

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).