🎣 California vs DOT

Plus: Brad Jacobs stepping down, rate are up, though capacity is lessening, and New Prime hit with a nuclear verdict

Key trends in freight and shipping market of June 2023, with insights into spot market, carrier capacity, LTL sector and cross-border shipping.

This is a summary of Arrive Logistics Freight Market Update.

The summer peak season has spurred volatility in the spot market, with month-over-month load postings rising by 30%. Interestingly, this has not majorly disrupted contract service levels. As the gap between spot and contract rates persists, there's a downward pressure on contract rates. However, the spike in spot market activities suggests a return to regular seasonal demand patterns.

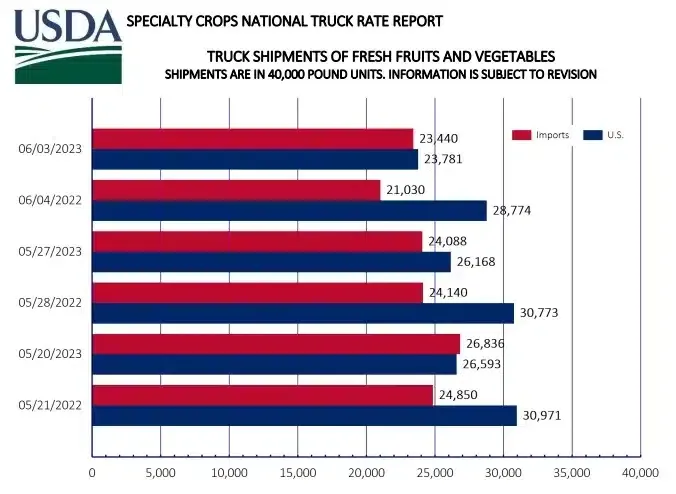

The Commercial Vehicle Safety Alliance (CVSA) Roadcheck week, coupled with a seasonal increase in produce activity, has been instrumental in driving up previously stagnant trucking rates. Over the past month, dry van and flatbed spot rates have increased in three out of four weeks, while reefer rates have stabilized after a notable rise in May. However, this surge is likely attributed to seasonal fluctuations rather than a fundamental market shift. Consequently, rates may continue to rise until the Fourth of July, after which they are expected to decrease somewhat promptly.

The cross-border shipping market, particularly between the US and Canada, is in shippers' favor. A surplus of capacity is leading to lower rates across various modes. An unexpected lull in the produce season in Mexico is softening conditions, leading to a slowdown in volume movement. However, the impending peak summer season, especially for temperature-controlled and flatbed sectors, is expected to tighten capacity and push rates up.

In the Less Than Truckload (LTL) sector, YRC is facing a financial crisis with a significant drop in tonnage. If their financial needs aren't met soon, they may exhaust funds by August, potentially disrupting the overall US LTL network. This could overburden other carriers or push the network to absorb the extra freight.

The 2023 freight and shipping market displays some vulnerabilities amidst robust consumer sentiment and a healthy labor market. The market balance is shifting towards normalizing capacity, which could influence rate dynamics and power balances. While the summer peak may temporarily elevate rates, long-term disruptions are unlikely. However, the markets could face a potential shake-up as capacity gradually normalizes throughout the year.

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).