🎣 The Perfect Stolen Load

Plus: backlash over carrier safety rankings, the Port of LA’s push toward 10M TEUs, states expanding ICE enforcement, and more in today’s newsletter.

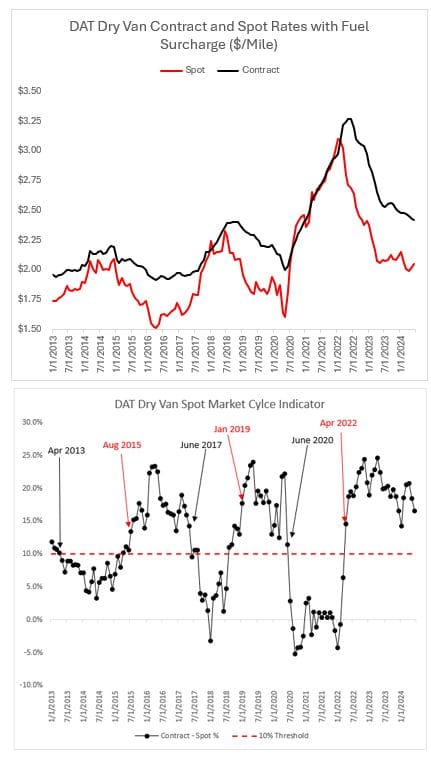

Supply chain professor Jason Miller analyzes June truckload data, suggesting the market won't meaningfully flip to carriers until Q2 2025 at the earliest.

As we gear up for July 4th barbecues, trucking companies aren't finding much to celebrate. Supply chain expert Jason Miller's latest analysis of June dry van truckload spot rates paints a pretty bleak picture for carriers hoping for a market turnaround.

"June's spot rate increase is quite weak relative to what we've traditionally seen in dry van TL bull markets." - Jason Miller, Supply Chain Professor.

"Folks who predicted the dry van truckload market flipping from bear to bull in late Q2 or early Q3 likely made an overly optimistic forecast." - Jason Miller

The data suggests carriers hoping for a quick turnaround are in for a rude awakening. The current market conditions appear far more durable than many industry observers predicted.

While unexpected events could always shift the landscape, it looks like shippers will continue to hold pricing power for the foreseeable future. Carriers may need to hunker down and focus on efficiency to weather this extended winter in freight rates.

Source: Jason Miller/LinkedIn

Join over 14K+ subscribers to get the latest freight news and entertainment directly in your inbox for free. Subscribe & be sure to check your inbox to confirm (and your spam folder just in case).